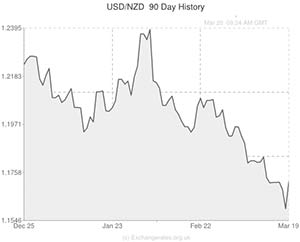

The USD to NZD Exchange rate climbed to a one-week high following the release of disappointing GDP data in New Zealand and as the US Federal Reserve hinted that interest rates could rise as soon as next year.

Official domestic data released in New Zealand showed that the small south pacific nation’s GDP expanded by 0.9% in the fourth-quarter of 2013, disappointing economists who had forecast that the economy would expand by 1%. GDP in the third-quarter was also revised downwards to 1.2%, down from the previous reading of a 1.4% increase.

On a yearly basis GDP increased by 3.1%, slower than the revised 3.3% figure for the third-quarter and matched forecasts. Despite the disappointing data, expectations for an interest rate rise increased.

“The Reserve Bank of New Zealand is set to keep moving the cash rate towards less stimulatory settings. The outlook is for a solid pace of expansion in 2014, which confirms the cash rate should be lifted towards the 4.5% neutral zone,” said a senior economist at ANZ Bank Ltd.

The US Dollar meanwhile made gains against the majority of its most traded peers after the Federal Reserve said that it will taper its monthly bond buying programme by a further $10 billion to $55 billion.

The ‘Greenback’ pushed higher after Federal Reserve Chairman Janet Yellen suggested that the Central Bank could raise interest rates six months after the bond buying programme ends. The programme is expected to end later this year.

The ‘Kiwi’ is likely to soften further against the US Dollar later in the session if today’s US jobless claims data comes in better-than-expected. A positive report will further bolster the US currency against its peers.

New Zealand Dollar (NZD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

New Zealand Dollar, ,US Dollar,0.8543 ,

,US Dollar,0.8543 ,

New Zealand Dollar, ,British Pound,0.5156 ,

,British Pound,0.5156 ,

New Zealand Dollar, ,Euro,0.6162 ,

,Euro,0.6162 ,

New Zealand Dollar, ,Australian Dollar,0.9463 ,

,Australian Dollar,0.9463 ,

[/table]

Comments are closed.