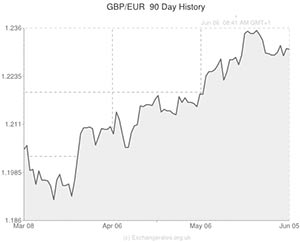

The Pound to Euro exchange rate (GBP/EUR) rallied by around 0.8 cents yesterday afternoon in the aftermath of the European Central Bank’s decision to loosen monetary policy in June.

Deflation in the 18-nation bloc is currently the largest concern among policymakers and Draghi’s latest measures are aimed at improving liquidity to help drive consumer prices higher.

If liquidity increases in the Eurozone then it is possible that businesses will create more jobs, pay higher wages and spur spending in the real economy. This should help drive consumer prices higher as demand swells.

GBP/EUR jumped from 1.2315 to a 1.5-year high of 1.2396 in a knee-jerk reaction to ‘Super’ Mario Draghi’s latest unprecedented steps to quell the crisis in the Eurozone.

Having effectively rescued the currency bloc from the precipice of collapse back in the summer of 2012 with a promise to “do whatever it takes” to save the single currency, Draghi announced yesterday that commercial banks will now be charged -0.10% to hold funds at the ECB. No other major central bank has implemented this strategy before, meaning that its efficacy is questionable, but the idea is that commercial banks will look to avoid the 0.10% charge by lending to consumers and small businesses (boosting liquidity), where they can charge interest.

The ECB chief also announced a reduction in the benchmark interest rate from 0.25% to a new all-time low of 0.15%. This move was hardly groundbreaking, and the effects of lower borrowing costs are estimated to take between 4-6 quarters to take effect, but the decision to cut rates could have an instant impact if it leads to a depreciation of the Euro.

Smaller yields on European deposits are likely to perturb investors from purchasing assets based in the Eurozone and the subsequent weakening of the Euro exchange rate could help spur inflation as import prices surge.

Another measure announced yesterday saw the ECB Chairman signal an end to the ‘sterilisation’ of sovereign bonds purchased between 2011-2012. This will essentially lead to an injection of €164 billion into European financial markets.

Draghi’s final attempt to stoke inflation through increased liquidity saw the ECB Chief unveil a new programme of cheap loans, aimed solely at small to medium sized enterprises. SMEs account for around 75% of total employment in the currency bloc and as such they are seen as the lifeblood of the Eurozone economy. The new scheme will see the ECB provide banks in the region with around €400 billion of cheap credit that must be lent to SMEs.

It remains to be seen how effective the ECB’s latest stimulus measures will be at stoking price pressures and dragging the Eurozone away from a period of Japan-style stagflation. Interestingly, Sterling’s initial rally against the single currency ran out of steam fairly quickly and GBP/EUR receded back down to 1.2325. This suggests that investors are not completely convinced by the ECB’s latest bout of monetary easing.

Comments are closed.