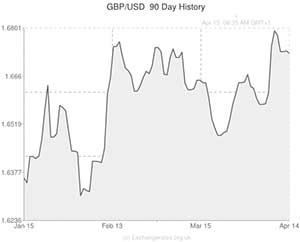

The Pound to US Dollar exchange rate (GBP/USD) remained relatively flat at 1.6725 yesterday, despite the fact that US Advanced Retail Sales printed at their highest level for 1.5 years.

The encouraging 1.1% monthly acceleration in March beat forecasts of 0.7% and marked a sizable improvement on February’s 0.3%. The report showed that sales volumes rose in nearly all categories, signaling that the US economy – the world’s largest – is recovering well from the negative impact of the freezing conditions at the beginning of the year.

Historically, US GDP output often rebounds strongly following periods of weather-induced slowdown. This could bolster demand for the ‘Greenback’ over the next few months if economic indicators begin to signal that second quarter growth is on track to impress.

However, the US Dollar is currently out of favour with investors due to the Federal Reserve’s dovish policy statement last week. The FOMC Minutes revealed that the majority of policymakers are concerned that the economic recovery could be undone if ultra loose monetary stimulus is withdrawn prematurely.

GBP/USD rose to within 3 pips of a fresh 4-year high last week in the aftermath of the Fed Minutes report.

Later on today, data is expected to show that UK inflation fell to its lowest level since 2009 during March, which could compromise demand for Sterling during the morning. If CPI falls to 1.6%, as expected, or lower, the Pound could lose some ground against the ‘Greenback’.

This daily swing could be exacerbated if US Consumer Prices print at 1.6%, inline with the median forecast, as this would mark an optimistic improvement on the previous result of 1.1%.

However, the Pound to US Dollar exchange rate (GBP/USD) has the potential to power back into life on Wednesday if the latest UK labour market data comes in positively. The headline Unemployment Rate is anticipated to drop from 7.2% to 7.1% and the Average Weekly Earnings barometer is expected to rise from 1.3% to 1.7%.

If all figures match the forecasts then it will mark the first time in over four years that earnings have outpaced inflation and wages have grown in real terms.

Under these circumstances it is entirely likely that Sterling could push back above 1.6800 on Wednesday.

However, if the situation in Ukraine continues to weigh on the minds of investors then the Pound could struggle against the US Dollar due to safe haven demand for the ‘Greenback’ – the world’s go-to reserve currency.

Comments are closed.