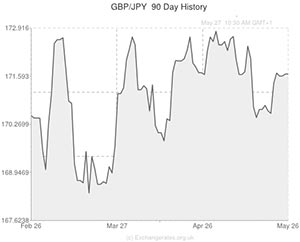

While bets surrounding the prospect of European Central Bank policy intervention have lessened demand for safe-haven assets, the Yen still began Tuesday in a stronger position against the Pound.

The Pound recovered some losses against the Yen having softened to a low of 171.5100 during Australasian trading in response to a bout of profit taking among investors.

Last week’s surprisingly upbeat UK inflation and retail sales reports upped the odds of the Bank of England introducing an interest rate increase before the spring of 2015 and boosted Sterling against its rivals.

The Pound hit a 17-month high against the Euro and rallied against several of its other commonly traded counterparts before investors cashed in and reversed some of the currency’s gains.

Overnight the Yen was also supported as a Japanese measure of small business confidence advanced from 45.4 to 46.6 in May.

Japan’s corporate service price also advanced by 3.4 per cent in April, year-on-year, rather than the 3.2 per cent expected.

Although the Yen was modestly stronger against the Pound, it declined against the US Dollar and brushed a week low against the Euro as investors focused on Bank of Japan Governor Haruhiko Kuroda’s upcoming conference.

On Monday the BOJ’s deputy Governor Kikuo Iwata intimated that enhancing Japan’s economic performance isn’t something that can be achieved through monetary policy but is the responsibility of the nation’s government.

In light of this, Kuroda’s comments will be of particular interest.

Some investors are still expecting the BOJ to introduce additional fiscal stimulus before the end of summer.

According to economist Janu Chan; ‘The BOJ is still more inclined for easing. If global risk appetite and the global economy continue to improve, the risk is that the Yen will weaken.’

The Pound held a modest decline against the Yen as European trading began in spite of a UK report showing an impressive increase in service company confidence.

The Confederation of British Industry consumer business optimism measure climbed to 53 from 43 – the strongest level since the index was introduced.

However, Sterling came under some pressure on Tuesday as the UK’s BBA loans for house purchase report for April showed a decline from a negatively revised 45,045 to 42,173.

A reading of 45,100 was expected.

Over the next few days Japanese reports to look out for include retail trade figures, jobless rate data, household spending figures, the National consumer price index and industrial production data.

Of course movement in the GBP/JPY pairing could also be driven by the UK’s consumer confidence measure, due out on Friday.

Japanese Yen (JPY) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,Japanese Yen,171.8790,

,Japanese Yen,171.8790,

Euro, ,Japanese Yen,138.9230 ,

,Japanese Yen,138.9230 ,

US Dollar, ,Japanese Yen,101.8200,

,Japanese Yen,101.8200,

Australian Dollar, ,Japanese Yen,94.2853 ,

,Japanese Yen,94.2853 ,

New Zealand Dollar, ,Japanese Yen,87.1376,

,Japanese Yen,87.1376,

Canadian Dollar, ,Japanese Yen,94.0096,

,Japanese Yen,94.0096,

[/table]

Comments are closed.