The Pound to US Dollar exchange rate softened on Tuesday as investors reacted to two very different sets of inflation figures.

While the UK’s consumer price index revealed that inflation was running at a 4 1/2 year low in May (giving Bank of England policy makers more scope to leave interest rates at record lows for longer) the US inflation report showed that consumer prices were up by the most for over 12 months.

On an annual basis US consumer prices were up 2.1 per cent in May, stronger than the year-on-year increase of 2.0 per cent recorded in April.

Month-on-month prices were up 0.4 per cent – double the 0.2 per cent monthly increase expected by economists and following a gain of 0.3 per cent the previous month.

The result prompted this repose from economist Samuel Coffin; ‘We’re seeing signs of pressure. Improvement in the labour market and continued signs of price pressures that are a bit greater than we’ve been seeing, that will encourage a new set of thinking for the Fed.’

Until now the Federal Reserve has held firm in its resolution to keep interest rates at record lows while steadily tapering the level of asset purchases, but if inflation achieves the central bank’s target levels sooner than anticipated this stance could be revised.

The data was a marked contrast with the earlier released UK consumer price index, which added to the case for the Bank of England leaving interest rates on hold beyond November.

Separate US data showed that the level of building permits issued in the nation fell by 6.4 per cent in May, month-on-month – a much steeper drop than the 3.9 per cent decline anticipated. This followed a negatively revised increase of 5.9 per cent in April.

Similarly, domestic housing starts were down by 6.5 per cent in May, this was also versus a forecast 3.9 per cent drop. April’s month-on-month increase in housing starts was downgraded to 12.7 per cent.

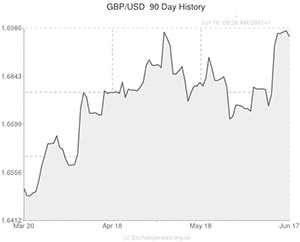

After the reports were released the US Dollar advanced on several of its most traded rivals, achieving a two-week high against the ‘Aussie’, pushing higher against the Euro and Yen and bringing the Pound’s recent bullish run to an end.

Volatility in the GBP to USD exchange rate could be occasioned tomorrow as the minutes from the Bank of England’s June policy meeting are published. It is expected that the minutes will offer a greater insight into the potential timeline for the raising of interest rates. If it seems as though the 9-member Monetary Policy Committee are becoming increasingly divided on the issue the Pound could rally. Of course the Federal Open Market Committee’s interest rate decision will also be in focus.

The GBP to CAD exchange rate was slightly stronger as tensions in Iraq continue to undermine higher-risk and commodity-driven assets.

GBP to USD Update – 18/06/14

The Pound is little changed against the US Dollar and remains close to its highest level in five years as economists await the release of the latest Bank of England policy meeting minutes and tonight’s Federal Reserve interest rate decision. Sterling is likely to see gains as it is widely expected that the BoE minutes will give further support to expectations that policy makers are keen to raise interest rates sooner than the markets expect.

The Federal Reserve meanwhile is anticipated to be more hawkish over the health of the world’s largest economy and investors will be hoping to see some indications that suggest that the Fed is getting closer to raising interest rates. Strategists are expecting the US Dollar to rally following the policy decision as optimism continues to mount that the US economy is strengthening.

Comments are closed.