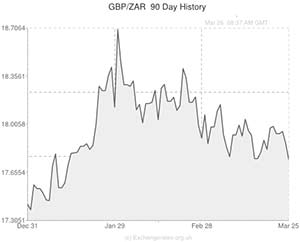

Before the South African Reserve Bank delivers its rate decision tomorrow, the Rand is trading close to a one-week high against the US Dollar and holding on to recent gains against the Pound.

South African economic data might be limited this week, but hopes that China will introduce stimulus to shore up its flagging economic growth supported emerging market currencies like the Rand and a period of calm in Ukraine helped boost risk appetite.

Although the Rand tracks the Euro, yesterday’s disappointing German business sentiment figures and European Central Bank President Mario Draghi’s fairly dovish comments in Paris had little impact on South Africa’s currency.

Similarly, this morning’s report confirming that GfK consumer confidence in Germany came in at 8.5 in April (unchanged from March) barely caused a ripple in the market.

Indeed, investors have primarily been focusing on Thursday and the announcement of the South African rate decision.

The majority of investors are anticipating no changes being made to policy.

According to an industry expert with the Rand Merchant Bank; ‘The latest bout of Rand strength has seen the market erring on the side of caution and gravitating towards a 25 basis point hike or no-move scenario.’

Tomorrow’s South African producer price index could also be responsible for driving Rand movement.

In January the PPI advanced by 1.0 per cent month-on-month and 7.0 per cent year on year.

While the Pound posted modest gains against several of its major rivals after Bank of England policy marker Martin Weale supported the case for interest rate increases, the British currency failed to strengthen against the Rand.

Weale was quoted as stating; ‘Obviously, as the economy recovers, the interest rate isn’t going to stay at half a per cent indefinitely. While my best guess is any rises will be relatively gradual, the committee can’t give any guarantees about where interest rates will be’.

While tomorrow’s UK retail sales figures could have an impact on the GBP/ZAR exchange rate, South Africa’s economic news will be the major cause of currency volatility.

That being said, investors will also be taking an interest in China’s leading index before the weekend.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.6329,

,South African Rand,17.6329,

Euro, ,South African Rand,14.7469,

,South African Rand,14.7469,

US Dollar, ,South African Rand,10.7294,

,South African Rand,10.7294,

Australian Dollar, ,South African Rand,9.8398,

,South African Rand,9.8398,

New Zealand Dollar, ,South African Rand,9.2843,

,South African Rand,9.2843,

Canadian Dollar, ,South African Rand,9.6479,

,South African Rand,9.6479,

[/table]

Comments are closed.