Before Federal Reserve Chairman Janet Yellen testified to the Senate on the subject of US fiscal policy the US Dollar was holding steady against its main rivals.

The American currency was enjoying a more bullish relationship with several of its peers as concerns that the situation in the Ukraine is escalating pushed investors towards safe haven assets.

‘Greenback’ gains were also enabled as a report showed a smaller-than-forecast decline in US durable goods orders and another revealed a third week of rising US consumer sentiment.

The US Dollar then pushed higher as Yellen reasserted that the Fed will probably continue with its current policy of slowly and steadily tapering stimulus.

While addressing the Senate Banking Committee Yellen stated that the financial institution ‘will likely reduce the pace of asset purchases in further measured steps at future meetings.’

She added; ‘My colleagues on the Federal Open Market Committee and I anticipate that economic activity and employment will expand at a moderate pace this year and next, the unemployment rate will continue to decline towards its longer-run sustainable level, and inflation will move back toward 2 per cent over coming years.’

Some reference was made to the impact of the unseasonably harsh winter, with Yellen observing that some of the soft data published in recent weeks could be attributed to it.

Yellen did also observe that the recovery of the labour market is far from complete, as was evidenced today by a report showing that US initial jobless claims climbed to a one-month high last week.

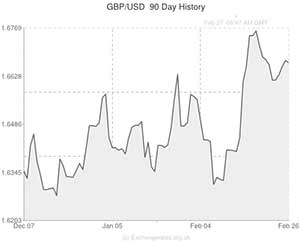

The Pound meanwhile lost a little ground after the Lloyds business barometer shed ten points between January and February and British lawmakers offered mixed perspectives on the prospect of an interest rate increase occurring next year.

As the week draws to a close currency market volatility is likely to occur in response to the UK consumer confidence survey, Eurozone inflation figures and US growth data.

If tomorrow’s US GDP figures fall short of forecasts the Fed may end up having to revise its timetable for tapering stimulus after all.

Economists have predicted that the US economy expanded by an annualised 2.5 per cent in the fourth quarter of 2013 following growth of 3.2 per cent in the third.

The University of Michigan Confidence Index will also be of interest.

US Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Pound Sterling,0.5983,

,Pound Sterling,0.5983,

US Dollar, ,Canadian Dollar,1.1072,

,Canadian Dollar,1.1072,

US Dollar, ,Euro,0.7269,

,Euro,0.7269,

US Dollar, ,Australian Dollar,1.1085,

,Australian Dollar,1.1085,

US Dollar, ,New Zealand Dollar,1.2045 ,

,New Zealand Dollar,1.2045 ,

Canadian Dollar, ,US Dollar ,0.9022 ,

,US Dollar ,0.9022 ,

Pound Sterling, ,US Dollar,1.6713 ,

,US Dollar,1.6713 ,

Euro, ,US Dollar,1.3758,

,US Dollar,1.3758,

Australian Dollar, ,US Dollar,0.9032,

,US Dollar,0.9032,

New Zealand Dollar, ,US Dollar,0.8331 ,

,US Dollar,0.8331 ,

[/table]

Comments are closed.