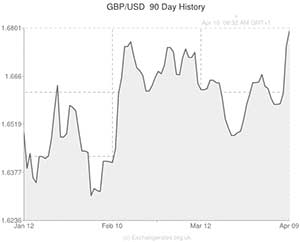

The Pound to US Dollar exchange rate (GBP/USD) reached a fresh monthly high of 1.6765 yesterday afternoon and Sterling rallied by another half-cent to 1.6790 in reaction to the latest FOMC Minutes report.

The Minutes showed that Federal Reserve officials are keen to maintain accommodative stimulus in order to boost lending and spur business investment.

Fed Chair Janet Yellen said:

“Most participants favoured providing an explicit indication in the statement that the new forward guidance, taken as a whole, did not imply a change in the Committee’s policy intensions“

Stocks rose and the Dollar weakened across the board in reaction to the report, which was seen to signal that ultra loose monetary policy in the US is here to stay for a little while longer.

The dovish FOMC statement also boosted global risk sentiment, which helped to send Sterling lower against the commodity currencies:

GBP/NZD declined by a whole cent to 1.9250 and GBP/AUD tumbled by a quarter of a cent to 1.7870.

Earlier on in the day data showed that the UK Trade Balance improved slightly during February. The report indicated that imports slowed faster than exports, although both components cooled slightly. The visible Trade deficit improved from -£9.46 billion to -£9.09 billion, but the report had little impact on GBP/USD.

A separate report, from the British Retail Consortium, showed that UK shop prices plunged by -1.7% during March – the steepest decline in the eight year history of the report. Although the softness in price pressures indicates that businesses are having to go to great lengths to attract customers, the Pound was not punished on the currency market following the release.

Later today the Bank of England is almost certain to maintain its 0.50% benchmark interest rate and there is very little chance that policymakers will opt to make any amendments to the £375 billion asset purchasing target.

Barring a very unexpected policy change from the BoE, the only way that tomorrow’s Central Bank announcement could have a significant impact on Sterling is if Governor Mark Carney chooses to release a policy statement. Carney is not obliged to make a statement, and indeed he is not expected to, but if he does it will most likely be to guide markets as to when the Bank intends to start raising interest rates. If the Governor gives any hints that the BoE is looking to hike rates ahead of the current projected date – Q2 2015 – then demand for the Pound could surge.

Comments are closed.