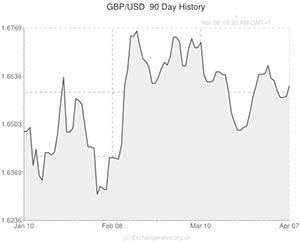

The Pound to US Dollar exchange rate (GBP/USD) grew by around half a cent during low trading volumes yesterday.

There were no key data releases related to either currency during the London session, which left the pair at the mercy of profit seeking investors. Technical trading patterns took GBP to USD from 1.6570 to 1.6620 during the afternoon. This could represent a relatively strong level for the Pound because events later on this week could bolster demand for the US Dollar.

Later this morning UK Industrial Production is predicted to print at 0.3% for February, up from 0.1% in January. If the result prints inline with economists’ forecasts then Sterling could muster up enough support to rise above technical resistance at 1.6620, however, if the report disappoints then GBP/USD could spiral lower.

Even if the Industrial Production numbers do impress there is a fairly strong chance that demand for the ‘Greenback’ could surge on Wednesday when the Federal Reserve releases the FOMC Minutes report from its meeting on March 18-19th. Following this meeting Fed Chair Janet Yellen told reporters that interest rates could be hiked as early as six months after the QE3 scheme has been fully wound down. Prior to Yellen’s comments markets had anticipated a much longer wait of around twelve months. The hawkish remarks caused some investors to price in an interest rate rise for April next year and drove GBP/USD down to a 49-day low of 1.6466.

Last week Janet Yellen reaffirmed her commitment to keeping interest rates low and this went some way to tempering the rate hike speculation. However, if the FOMC Minutes report shows that policymakers are keen to move away from the Fed’s current easing cycle and begin tightening monetary policy then it is entirely possible that GBP/USD could start to slide towards or below 1.6500.

Investors will also be looking to the report for clues as to what economic thresholds will need to be met to trigger a rate increase from the Fed. If any such criterion is disclosed, and if it is deemed easily attainable, then demand for the US Dollar could rocket.

With US Non-farm Payrolls coming in close to 200,000 in both February and March it is now apparent that the economic slowdown in the States at the start of the year was not as pronounced as first thought.

Interestingly, if you look at the performance of the US economy following periods of extremely cold weather there is usually a strong reaction. If US GDP rebounds strongly in the second quarter, as it has done historically in the aftermath of inclement weather, then there is every chance that US rate hike speculation will continue to proliferate throughout the year. This could lead to a softer Sterling to US Dollar exchange rate (GBP/USD).

Comments are closed.