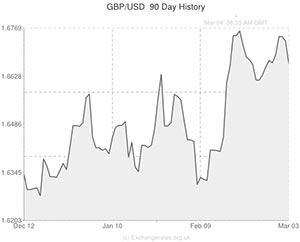

The Pound to US Dollar exchange rate tumbled through support levels following the close of the London session yesterday. GBP/USD declined from 1.6730 to 1.6645 overnight as global risk trends, as well as positive US data, underpinned demand for the ‘Greenback’.

The world’s premier safe haven currency the – US Dollar – absorbed defensive inflows from around the world last night as jittery investors parked their funds in US Treasuries to safeguard against Ukraine-related fluctuations across financial markets.

With Russian President Vladimir Putin adamant that he has every right to continue with his military incursions into Ukraine – Russian troops have already taken over the Ukrainian peninsula of Crimea – many stock markets around the world fell victim to panic selling yesterday.

The FTSE 100 index of top British stocks declined by -1.5%, the S&P 500 US equity index tumbled by -0.75%, the German DAX plummeted by -3.4% and the Russian MICEX shed -10.8%. The heavy MICEX losses saw -$58.4 billion wiped from the Russian stock market in just one day; more than the $51 billion that was spent on hosting the entire Sochi Winter Olympic Games.

The US Dollar benefitted from this risk-off phenomenon because it is the most widely used currency in the world and therefore seen as more capable of absorbing shocks than other asset classes.

Traders are anxious that the selloffs could continue over the next few days/weeks if the situation in Eastern Europe deteriorates. The United States and the European Union have both threatened to isolate Russian economically if it does not back down. These sanctions could include: visa bans, trade restrictions or asset bans – all of which would most likely have a negative impact on the global economy. Worse still: Russian could decide to cutoff its oil supply lines to Western Europe in retaliation.

For this reason it is possible that GBP/USD will struggle to push back above support at 1.6720 whilst investors are still shrouded in uncertainty from the conflict.

The US Dollar also benefitted from a stronger-than-expected rise in Manufacturing output. The headline ISM index of factory output rose from 51.3 to 53.2 during February, confounding expectations of 52.0 as the affects of the cold weather wore off.

A separate report showed that US Personal Spending printed four times stronger than initially estimated in January. The 0.4% increase was interpreted as positive for the ‘Greenback’ because domestic spending accounts for around 70% of US GDP.

The robust US dataset yesterday was seen to boost the probability that the Federal Reserve will continue with its tapering of asset purchases at measured steps over the next few months. However, Friday’s Non-farm Payroll number could cause dovish speculation to arise once more if the figure disappoints for a third month running.

Although not strictly in its mandate, the burgeoning risk aversion moves and emerging market selloffs could also play a part in the Fed’s decision.

UK Construction is predicted to have increased at a rate of 63.2 during February and the PMI report is set to be released later this morning. It could take a score of 64.6 or above to give Sterling a significant boost against the US Dollar during this period of soft risk sentiment.

Comments are closed.