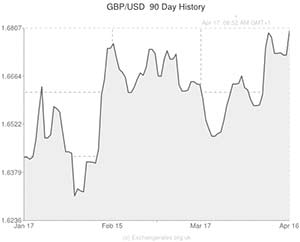

During North American trading yet more upbeat US economic news helped the US Dollar recover ground, but the GBP to USD exchange rate is still heading into the weekend close to a four-year high.

This afternoon separate reports showed that US consumer comfort climbed from a nine-week low while applications for initial jobless claims were close to their lowest level for nearly seven years in the week ending April 12th.

Jobless claims rose to 304,000 rather than jumping to 315,000 as expected by economists.

Meanwhile, total applications for unemployment benefits hit pre-recession levels.

Senior US economist Brian Jones said this of the jobless claims report; ‘Not only have you had a slowdown in layoffs, but also the total number of people on state benefit rolls has fallen. The labour market is getting better.’

However, the US Dollar came under pressure yesterday as Federal Reserve Chairman Janet Yellen spoke at the Economic Club of New York. The ‘Greenback’ posted widespread declines after Yellen stated; ‘The larger the shortfall of employment or inflation from their respective objectives, and the slower the projected progress toward those objectives, the longer the current target range for the federal funds rate is likely to be maintained.’

The Pound, meanwhile, was still riding high from yesterday’s impressive UK employment figures.

Sterling posted its strongest gain against the Euro for six weeks on Wednesday and achieved an over four year high against the US Dollar.

Although next week’s minutes from the recent Bank of England policy meeting could take the wind out of Sterling’s sales, for the moment the currency performing strongly.

Some industry experts, like London-based currency strategist Lee Hardman, believe that the Bank of England will increase interest rates before the Federal Reserve. Hardman commented; ‘What Yellen said reinforced a market view that […] any increases in interest rates in the future will be gradual. This may be negative for the Dollar in the near term. The Pound is outperforming and our view is that the Bank of England will be the first to raise rates’.

This thought process could give the Pound to US Dollar pairing a neutral-positive bias in the short term.

Next week US news to look out for includes the nation’s existing home sales report, Markit PMI, durable goods orders and services figures.

US Dollar (USD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Pound Sterling,0.5950,

,Pound Sterling,0.5950,

US Dollar, ,Canadian Dollar,1.0996,

,Canadian Dollar,1.0996,

US Dollar, ,Euro,0.7220,

,Euro,0.7220,

US Dollar, ,Australian Dollar,1.0696,

,Australian Dollar,1.0696,

US Dollar, ,New Zealand Dollar,1.1590 ,

,New Zealand Dollar,1.1590 ,

Canadian Dollar, ,US Dollar ,0.9094,

,US Dollar ,0.9094,

Pound Sterling, ,US Dollar,1.6806,

,US Dollar,1.6806,

Euro, ,US Dollar,1.3837,

,US Dollar,1.3837,

Australian Dollar, ,US Dollar,0.9353,

,US Dollar,0.9353,

New Zealand Dollar, ,US Dollar,0.8598 ,

,US Dollar,0.8598 ,

[/table]

Comments are closed.