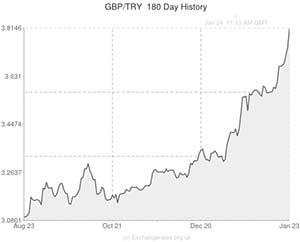

In spite of the Turkish central bank’s best efforts, the Lira selloff persisted overnight and the emerging market asset fell to fresh record lows against the ‘Greenback’ while weakening considerably against peers like the Pound and Euro.

The Lira’s appeal was dampened earlier in the week by the news that China’s manufacturing sector unexpectedly contracted for the first time in six months.

A HSBC/Markit gauge slipped from 50.5 to 49.6 in January.

The Chinese data inspired this response from one HSBC economist; ‘The marginal contraction of January’s headline HSBC Flash China manufacturing PMI was mainly dragged by cooling domestic demand conditions. This implies softening growth momentum for manufacturing sectors, which has already weighed on employment growth’.

Of course, investors also turned from the Lira amid speculation that the Federal Reserve intends to continue tapering stimulus in a slow-but-steady way.

The Lira’s extensive declines prompted the Turkish central bank to direct currency sales for the first time in two years, but even their best efforts did little to stem the emerging-market currency exodus.

According to strategist Luis Costa; ‘It’s been a concerted selloff in emerging market currencies, a day of big losses for the high-yielding pack across the board. Turkey is the classic example. Current account is still huge and we have political layers. The story in the Lira is extremely complicated and at 2.3 it has much further to go. We are short of the currency. The move has been way too fast and has broken all forecasts.’

The Pound has also been supported against the Lira by this week’s surprisingly strong UK employment figures.

If next week’s UK data, including fourth quarter growth figures, a mortgage approvals report and consumer confidence survey, add to the case for the Bank of England raising interest rates earlier than expected the Lira could fall further still against its British counterpart.

Meanwhile, Turkish data to be aware of includes the nation’s business/consumer confidence figures and balance of trade report.

Of course, the Federal Open Market Committee rate decision (taking place on Wednesday the 29th) will also have a significant impact on the currency market.

Current Turkish Lira (TRY) Exchange Rates:

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,Turkish Lira,3.8440 ,

,Turkish Lira,3.8440 ,

US Dollar, ,Turkish Lira,2.3120 ,

,Turkish Lira,2.3120 ,

Euro, ,Turkish Lira,3.1626 ,

,Turkish Lira,3.1626 ,

Australian Dollar, ,Turkish Lira,1.9895 ,

,Turkish Lira,1.9895 ,

New Zealand Dollar, ,Turkish Lira,1.8304 ,

,Turkish Lira,1.8304 ,

[/table]

Comments are closed.