Yesterday’s positive report from the British Chambers of Commerce regarding the UK’s economic outlook left the Pound stronger against several of its major rivals.

The report detailed improved confidence among UK businesses and intimated that the recovery is likely to continue at its current pace in the near term.

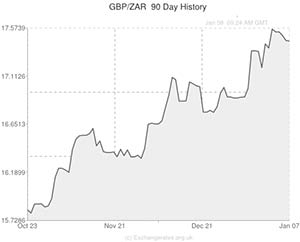

The Pound was therefore able to consolidate and extend gains against the Rand during Wednesday’s European session in spite of data showing a dip in UK house prices.

As Sterling received underlying support from the expectation that the Bank of England will leave the level of asset purchases unaltered, the commodity driven Rand came under pressure as better-than-forecast US trade balance data added to the case for the Federal Reserve tapering the level of bond buying by a further 5 billion US Dollars when it meets later this month, dampening the appeal of higher-risk assets.

Although the Rand was able to claw back some losses during local trading after domestic foreign exchange reserves data surprised to the upside, gains were minimal ahead of the publication of minutes from December’s FOMC meeting.

Reserve Bank of South Africa figures showed that net gold/foreign exchange reserves climbed from 45.43 billion US Dollars in November to 45.479 billion US Dollars in December.

But the Rand remained close to a five-month low against the US Dollar and was softer against the Pound.

Given the current instability of South Africa’s labour market and the weak domestic data published in recent weeks, economists believe that further Rand declines are likely.

According to economist Christie Vijoen; ‘Unfortunately, with South Africa’s gaping current account deficit and labour tensions able to cripple local economy, investors are looking to send money elsewhere.’

As the Rand tracks the Euro, the South African currency was also affected by worrying Italian employment figures, although the impact of this was slightly outweighed by a stronger-than-forecast gain in Eurozone retail sales.

While tomorrow’s Bank of England rate decision is likely to drive GBP/ZAR movement, the Rand will also react to South African manufacturing production figures, due out at 11:00 am GMT.

Current South African (ZAR) Exchange Rates:

< Down > Up

The US Dollar/South African Rand Exchange Rate is currently in the region of: 10.6112 >

The Pound Sterling/South African Rand Exchange Rate is currently in the region of: 17.4231 >

The Euro/South African Rand Exchange Rate is currently in the region of: 14.4311 >

The Australian Dollar/South African Rand Exchange Rate is currently in the region of: 9.4612 >

The New Zealand Dollar/South African Rand Exchange Rate is currently in the region of 8.7659 <

The Canadian Dollar/South African Rand Exchange Rate is currently trading in the region of 9.9400 <

(Correct as of 10:00 GMT)

Comments are closed.