Overnight the Rand slipped against several of its major rivals as the appeal of commodity-driven currencies faltered in the face of less-than-impressive manufacturing data for China, the world’s second largest economy.

Although market movement was a little stilted as traders recover from the New Year break, the Rand also consolidated declines against its US counterpart.

While the Rand was little affected by domestic private sector credit figures the currency did derive some support from the fact that gold enjoyed a rebound.

After experiencing its most severe drop in thirty years gold approached a two-week high.

According to one commodities expert; ‘The Fed is out, that’s cleared, so with no incremental news flow on the monetary-policy front and shorts remaining elevated, we see some of that being squared and giving gold some temporary support.’

Over in the UK, the nation’s manufacturing PMI edged down from the 33-month high of 58.1 recorded in November to 57.3 in December.

The UK result might not have been as strong as expected but it still indicates that the British manufacturing sector continued to perform well at the end of 2013.

As well as signalling an eighth consecutive month of climbing manufacturing employment the index showed a ninth month of rising new export business.

The rate of growth in production and new orders remained high and the average PMI reading for the fourth quarter came in at 57.2, the best result since 2011.

In a statement issued with the report David Noble of the Chartered Institute of Purchasing and Supply commented; ‘UK manufacturing ended 2013 on a high and with all signs of powering ahead into 2014. […] The sector’s broad based expansion was underpinned by strong domestic demand and improved export orders, all of which are signs of an underlying trend of continuing growth going into the New Year’.

However, while the Pound strengthened in the wake of the PMI’s publication Noble did also asset; ‘The only area of concern is the cost inflationary pressure which continued to build up during this final month, with input price inflation hitting a 28-month high.’

Before the weekend additional GBP/ZAR movement is likely to occur as a result of tomorrow’s South African foreign exchange reserves and vehicle sales data.

Of course, the UK construction report will also be of considerable interest.

Current South African (ZAR) Exchange Rates:

< Down > Up

The US Dollar/South African Rand Exchange Rate is currently in the region of: 10.5960 >

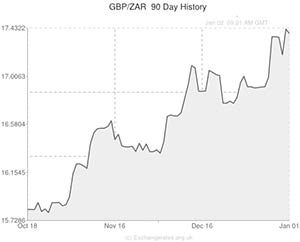

The Pound Sterling/South African Rand Exchange Rate is currently in the region of: 17.5718 >

The Euro/South African Rand Exchange Rate is currently in the region of: 14.4473 >

The Australian Dollar/South African Rand Exchange Rate is currently in the region of: 9.3259 >

The New Zealand Dollar/South African Rand Exchange Rate is currently in the region of 8.5894 >

The Canadian Dollar/South African Rand Exchange Rate is currently trading in the region of 9.7277 <

(Correct as of 10:45 GMT)

Comments are closed.