As investors rediscovered their appetite for higher-risk assets the Rand was able to advance modestly on rivals like the Pound and Euro.

Although the South African asset was little changed against the US Dollar, it eked out slight gains as the local session began and eyes turned to the upcoming central bank announcements in Europe.

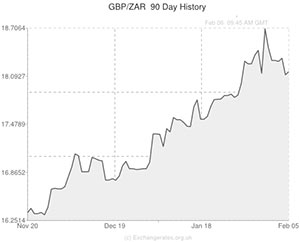

The UK’s disappointing services report helped the Rand gain on the Pound yesterday and the GBP/ZAR pairing was little-changed after a report revealed a stronger-than-forecast increase in UK house prices in January.

The 1.1 per cent month-on-month seasonally adjusted increase in house prices helped fuel concerns regarding a UK housing bubble but had barely any impact on the Pound.

Economist Howard Archer said this of the results; ‘The strong Halifax data will fuel concern that a house price bubble is developing. While concern over the strength of house price rises has been primarily focused on London, it is evident from a number of recent surveys […] that the strength in house prices is becoming more widespread.’

Although the unresolved platinum sector strike is restraining the Rand’s upward momentum, emerging market assets were boosted overnight as Mexico had its credit-rating upgraded by Moody’s Investors Service.

As economic data for South Africa is fairly limited over the rest of this week, Rand movement will be driven by global developments and both of today’s central bank announcements could have an impact on the currency.

Given that the Rand tracks the Euro, the European Central Bank rate decision will be of particular interest. In the opinion of Rand Merchant Bank analysts, the ECB is unlikely to loosen policy ‘even though they stunned the market last year by cutting much sooner than had been anticipated. The pressure on them to act is growing, given the very low inflation rate in the Eurozone.’

Meanwhile, the GBP/ZAR pairing could soften further if the Bank of England maintains its cautious attitude and leaves the pace of asset purchases unaltered. If the BoE stresses once again that interest rates will be held at record lows for the foreseeable future the Pound will be feeling the pressure ahead of tomorrow’s UK industrial/manufacturing production reports and trade balance figures.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.1426,

,South African Rand,18.1426,

Euro, ,South African Rand,15.0626,

,South African Rand,15.0626,

US Dollar, ,South African Rand,11.1377 ,

,South African Rand,11.1377 ,

Australian Dollar, ,South African Rand,9.8987,

,South African Rand,9.8987,

New Zealand Dollar, ,South African Rand,9.1145,

,South African Rand,9.1145,

Canadian Dollar, ,South African Rand,10.1134,

,South African Rand,10.1134,

[/table]

Comments are closed.