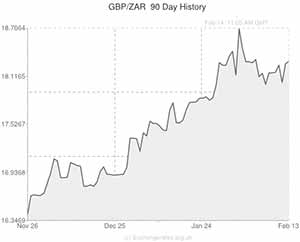

The South African Rand might have begun the local session slightly softer against the US Dollar, but the emerging-market asset retained its slight advance on the Pound following President Jacob Zuma’s speech.

In an attempt to revive confidence in the South African mining sector President Zuma urged striking workers and violent protesters to reconsider their actions for the sake of the nation’s economic stability.

While giving a state-of-the-nation speech in Cape Town Zuma asserted; ‘In no way can we have conflict that destroys the economy.

When protests threaten the lives and property and destroy valuable infrastructure intended to serve the community, they undermine the very democracy that upholds the right to protest.’

Although Zuma’s remarks had a negligible impact on the USD/ZAR pairing, the Rand was able to edge higher against Sterling despite the British currency being propped up by this week’s Bank of England inflation report.

Yesterday the Rand eased higher against the US Dollar as US retail sales figures surprised expectations for stagnation by showing a 0.4 per cent decline in sales in January, but the South African asset weakened back beyond the 11 Rand per Dollar level this morning.

Zuma’s speech also included a reference to the weaker Rand, he commented; ‘the weaker exchange rate poses a significant risk to inflation and will also make our infrastructure programme more expensive. However, export companies, particularly in the manufacturing sector, should take advantage of the weaker Rand and the stronger global economy’.

Although Zuma highlighted economic issues plaguing the nation, such as a 24 per cent unemployment rate and ongoing unrest in the labour market, many investors were disappointed in his failure to outline any kind of solution to these concerns.

In the opinion of one London-based economist; ‘We were disappointed, though not surprised, in that there was not a series of positive forward-looking statements on how the ANC can improve the economy. Everything is basically on pause now until after the election in policy terms.’

The Rand’s modest gain on the Pound came even as Sterling was supported by the news that UK construction output increased in the fourth quarter, gaining by 0.2 per cent rather than declining by 0.3 per cent as estimated in last month’s GDP figures.

Next week South Africa’s inflation figures, due out on Wednesday, are likely to influence Rand movement.

The GBP/ZAR pairing will also be driven by UK employment figures, the publication of minutes from the latest Bank of England policy meeting and the nation’s retail sales data.

Of additional interest is China’s HSBC/Markit Flash PMI, scheduled for release on Thursday.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.2546,

,South African Rand,18.2546,

Euro, ,South African Rand,15.0007,

,South African Rand,15.0007,

US Dollar, ,South African Rand,10.9075,

,South African Rand,10.9075,

Australian Dollar, ,South African Rand,9.8536,

,South African Rand,9.8536,

New Zealand Dollar, ,South African Rand,9.1552,

,South African Rand,9.1552,

Canadian Dollar, ,South African Rand,10.0053,

,South African Rand,10.0053,

[/table]

Comments are closed.