With the Reserve Bank of South Africa’s rate decision looming the Rand was able to climb to a two-week high against the US Dollar and trim losses against the Pound as investors rediscovered their appetite for emerging market assets in the wake of the Turkish central bank’s decision to raise interest rates.

The Rand snapped its recent run of extensive declines and surged by as much as 1.2 per cent against its US counterpart. However, the commodity-driven currency stayed trading lower against a buoyed Pound as domestic strike concerns persisted while the UK’s economic outlook brightened.

Turkey’s decision to increase interest rates and halt Lira losses was announced during the night and follows the unexpected 0.25 percentage point rate increase introduced by the Reserve Bank of India yesterday.

Although economists largely expect the Reserve Bank of South Africa to hold the policy rate at its current level, the prospect of a surprise move from this financial institution hasn’t been ruled out.

According to Johannesburg based strategist Mohammed Nalla, the ‘bold approach’ adopted by the Turkish central bank ‘has seen the Rand improve significantly. Talk is drifting to the possibility of a unexpected hike from the South African Reserve Bank Governor this afternoon.’

The Rand was also supported by the news that foreign investors purchased 398 million Rand of South African bonds on Tuesday.

Meanwhile, the Pound trimmed recent gains against several of its currency counterparts as investors tempered their reaction to yesterday’s UK growth report and looked ahead to today’s speech from Bank of England Governor Mark Carney.

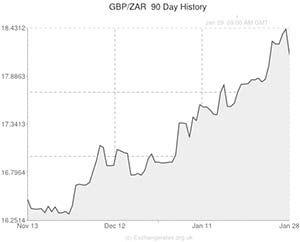

As Rand volatility is far from over for the week significant GBP/ZAR fluctuations could still occur.

If the Federal Open Market Committee shocks investors by either refraining from tapering stimulus this month or else by deciding to trim asset purchases by more than 10 million Dollars, extensive market movement can be expected.

In the days ahead the Rand could also be affected by South Africa’s private sector credit report, PPI figures and balance of trade data.

Friday’s UK consumer confidence report may also impact the GBP/ZAR pairing.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.4646 ,

,South African Rand,18.4646 ,

Euro, ,South African Rand,15.2137 ,

,South African Rand,15.2137 ,

US Dollar, ,South African Rand,11.0250 ,

,South African Rand,11.0250 ,

Australian Dollar, ,South African Rand,9.5735 ,

,South African Rand,9.5735 ,

New Zealand Dollar, ,South African Rand,9.2069 ,

,South African Rand,9.2069 ,

Canadian Dollar, ,South African Rand,10.0645,

,South African Rand,10.0645,

[/table]

Comments are closed.