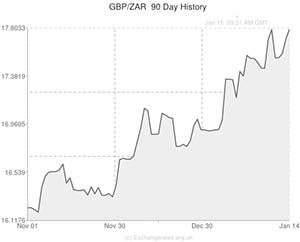

Before the publication of South African retail sales figures the Rand was close to a five-year low against the US Dollar and was trading lower against the Pound.

The Rand lost ground against these currency peers yesterday as they were boosted by upbeat retail sales and inflation reports respectively.

News that mining production in South Africa slowed by considerably more than expected also wore on the commodity-driven currency.

In the opinion of currency strategist Bruce Donald, the sales figure will be ‘consistent with a theme of weakening growth of consumer spending. [Mining numbers were] negative for the local currency market largely via the signal it sends on South Africa’s export performance.’

Economists expected that the pace of retail sales growth slowed from 1.3 per cent in October to 0.9 per cent in November.

Meanwhile, the Kagiso manufacturing PMI for South Africa dropped from 52.4 in November to 49.9 in December, below the 50 mark separating growth from contraction.

This was the first below 50 reading since April of last year.

However, while the headline figure looks bad, a Kagiso representative intimated that the index did average at 51 in the fourth quarter.

Although the nation’s business activity index fell to 49.3 the new sales orders index climbed to 51.8.

In comments issued with the figures Kagiso stated; ‘South Africa’s manufacturing PMI is now below our main trading partners. [But] despite the mixed news in December, respondents remained relatively optimistic about the first half of 2014. […] The employment index fell from a relatively high level of 50.8 reached in November to 45.8 index points in December. The deterioration was not unexpected, given that the manufacturing sector has struggled to create sustained employment growth since the 2008/9 recession.’

However, Rand fluctuations could occur in the hours ahead as South Africa’s retail sales figures delivered a surprise.

Sales climbed by 1.2 per cent in November, month-on-month, following a negatively revised decline of 0.4 per cent in October.

On the year sales were up 4.2 per cent, considerably better than the 1.0 per cent gain expected and much higher than October’s year-on-year rise of 1.3 per cent.

Before the weekend further movement in the GBP/ZAR pairing could occur in response to the UK’s own retail sales data, due for release on Friday.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.8167 ,

,South African Rand,17.8167 ,

Euro, ,South African Rand,14.8406 ,

,South African Rand,14.8406 ,

US Dollar, ,South African Rand,10.8935 ,

,South African Rand,10.8935 ,

Australian Dollar, ,South African Rand,9.6579 ,

,South African Rand,9.6579 ,

New Zealand Dollar, ,South African Rand,9.1390 ,

,South African Rand,9.1390 ,

Canadian Dollar, ,South African Rand,9.8760 ,

,South African Rand,9.8760 ,

[/table]

Comments are closed.