A surprisingly upbeat South African growth report helped the Rand advance on several of its most traded currency counterparts yesterday.

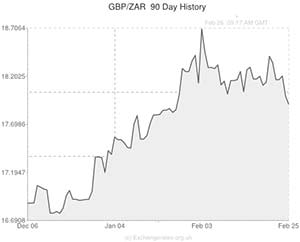

The emerging-market currency approached a six-week high against the US Dollar, but gains against the Pound were limited as the British asset was supported by its own domestic developments.

The news that UK mortgage approvals increased by more than anticipated in January helped Sterling strengthen, as did an unexpectedly positive CBI reported sales figure.

Further Pound gains were enabled as a Bank of England official intimated that interest rates could be increased as early as next spring.

The Pound was little-changed against the Rand following the release of UK growth data, which confirmed economic expansion of 0.7 per cent in the fourth quarter following growth of 0.8 per cent in the third.

The Rand fluctuated slightly before South Africa’s Finance Minister Pravin Gordhan delivered his budget speech to Parliament in Cape Town.

According to one Johannesburg-based strategic researcher, ‘The Rand remains very vulnerable.’

Recently the Rand has managed to trim its yearly decline against the US Dollar to 18 per cent. While some economists are hopeful that the currency’s gains might deter the Reserve Bank of South Africa from introducing additional rate hikes, others aren’t convinced that it will have any impact.

In the words of senior economist Christie Viljoen; ‘The few cents that the Rand gained recently doesn’t make a dent in the slide since a year ago. The influence of the Rand on inflation isn’t really going to make a difference. The currency is hopelessly too weak.’

The Rand posted modest but widespread declines after Gordhan cut budget-deficit targets for the next three years and argued that the softer Rand will boost export tax revenue.

Gordhan projected that South Africa’s budget deficit will hold at 4 per cent of GDP in 2015 before narrowing to 3.6 per cent in 2016.

Growth forecasts for South Africa were negatively revised. Gordhan predicted economic growth of 2.7 per cent rather than 3 per cent this year.

2015/2016 growth estimates were left unaltered at 3.2 per cent and 3.5 per cent respectively.

Tomorrow further Rand movement may be occasioned by South African PPI figures.

The nation’s trade balance data could impact the Rand’s exchange rate before the weekend, although Friday’s UK consumer confidence report will also drive GBP/ZAR movement.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.0640,

,South African Rand,18.0640,

Euro, ,South African Rand,14.8915,

,South African Rand,14.8915,

US Dollar, ,South African Rand,10.8349,

,South African Rand,10.8349,

Australian Dollar, ,South African Rand,9.7796,

,South African Rand,9.7796,

New Zealand Dollar, ,South African Rand,9.0341,

,South African Rand,9.0341,

Canadian Dollar, ,South African Rand,9.7965,

,South African Rand,9.7965,

[/table]

Comments are closed.