Although South Africa’s mining production report showed a 0.5 per cent month-on-month increase, the Rand continued putting in a patchy performance against the Pound as the local session continued.

An earlier report had shown that mining production in the nation slumped by 1.1 per cent in January, month-on-month.

On the year mining production was up 3.1 per cent and manufacturing production was up 2.5 per cent.

The Rand began Thursday slightly firmer against its US peer as the risk-aversion which dominated market movement yesterday eased in the wake of upbeat Australian employment data and the news that the Reserve Bank of New Zealand increased its key interest rate.

With the publication of advance US retail sales looming the Rand moved away from a two-week low against the ‘Greenback’.

As currency strategist John Cairns observed; ‘Global sentiment towards risk assets switched aggressively overnight and gains have continued this morning, with strong rises in Asian markets.’

However, the appeal of the Rand was dampened as yet more disappointing Chinese data added to the argument that the world’s second largest economy is experiencing a slowdown.

China’s industrial production and retail sales figures for February failed to reach forecast levels, with industrial output rising by an annual 8.6 per cent instead of the 9.5 per cent gain projected. Retail sales climbed by 11.8 per cent, 1.7 per cent less than estimated.

These disappointing figures follow concerning Chinese trade data and a report confirming that deflation is deepening.

Meanwhile, the Rand was also pushed lower against the Pound as a result of concerns that heavy rain in the east of the nation may prove damaging to South Africa’s economy.

Parts of South Africa are experiencing their wettest March for 17 years and flooding is becoming a serious issue.

In the opinion of Pretoria-based industry expert Johan van den Heever; ‘The flood damage is, in quite a number of ways, quite negative. One can see great expenditures having to be incurred in the next couple of quarters, perhaps, to revive elements of the infrastructure which has fallen behind through this.’

The Ukraine situation is also preventing emerging market currencies pushing higher.

However, the US Dollar was also feeling the pressure as one Federal Reserve official stated that the US employment situation warrants the continuation of fiscal stimulus. If US retail sales for February don’t advance by the 0.2 per cent forecast it will add to the case for the Fed reconsidering its tapering timeline and the ‘Greenback’ could fall.

With no South African reports due for publication tomorrow, further Pound/Rand movement is most likely to be triggered by UK trade balance and construction output figures.

Upbeat UK news may help the GBP/ZAR pairing end the week on a high.

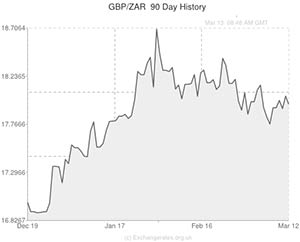

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.8552,

,South African Rand,17.8552,

Euro, ,South African Rand,14.9970,

,South African Rand,14.9970,

US Dollar, ,South African Rand,10.7220,

,South African Rand,10.7220,

Australian Dollar, ,South African Rand,9.6868,

,South African Rand,9.6868,

New Zealand Dollar, ,South African Rand,8.9862,

,South African Rand,8.9862,

Canadian Dollar, ,South African Rand,9.7139,

,South African Rand,9.7139,

[/table]

Comments are closed.