As the local session opened the Rand eased lower against several of its major currency counterparts.

The commodity-driven currency was feeling the pressure ahead of the publication of domestic inflation data – South Africa’s main economic news for the week.

Last month the Reserve Bank of South Africa surprised market expectations by raising interest rates for the first time since 2008. Borrowing costs were increased to 5.5 per cent in an attempt to counter inflation risks, so today’s report was expected to provide a good indication as to whether another rate hike might be forthcoming.

Before the report was release the Rand Merchant Bank asserted; ‘any surprise may result in a violent reaction from the market. We expect inflation to have registered 5.8 per cent year-on-year in January, slightly above the market consensus of 5.7 per cent. A higher reading than 5.8 per cent may indicate that Rand weakness is starting to have a larger influence on domestic prices and that the Reserve Bank may be forced to meet this increase with further rate increases.’

The RMB was spot on with the first half of its forecast.

The inflation rate did indeed come in at 5.8 per cent in January, year-on-year, up from an annual 5.4 per cent in December.

Inflation advanced by 0.7 per cent in January month-on-month, more than the 0.6 per cent gain expected.

The Rand’s slump against the US Dollar was cited as one of the reasons for the acceleration as it increased fuel and food costs.

Earlier this year one industry expert forecast that inflation would breach the central bank’s 3-6 per cent target in the second quarter of 2014 before peaking at 6.6 per cent before the end of the year.

Given today’s result that prediction is looking increasingly likely.

The odds of the Reserve Bank of South Africa introducing an additional rate increase when it meets in March rose after the report was published. Some analysts believe that an increase of 50 basis points is likely.

The data saw the Rand fall against several of its major currency counterparts, with the currency weakening to within touching distance of the 11 Rand per US Dollar level.

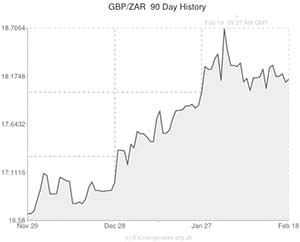

The Rand also declined against the Pound even as the British currency came under fire following the release of disappointing domestic employment figures. The news that Britain’s unemployment rate increased in the fourth quarter appears to support the argument that the UK’s economic recovery has lost some momentum.

A lack of South African data is likely to restrain further Rand movement as the week continues, although global developments will have an impact on the currency’s exchange rate.

Minutes from the Federal Open Market Committee meeting will be of particular interest.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.2052,

,South African Rand,18.2052,

Euro, ,South African Rand,14.9729,

,South African Rand,14.9729,

US Dollar, ,South African Rand,10.9425,

,South African Rand,10.9425,

Australian Dollar, ,South African Rand,9.7537,

,South African Rand,9.7537,

New Zealand Dollar, ,South African Rand,8.9932,

,South African Rand,8.9932,

Canadian Dollar, ,South African Rand,9.9040,

,South African Rand,9.9040,

[/table]

Comments are closed.