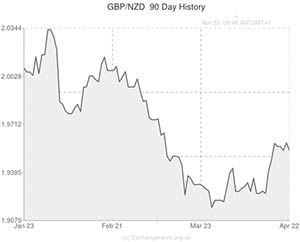

While Pound movement was restrained before the Bank of England’s meeting minutes were published, the Pound to New Zealand Dollar exchange rate began European trading in a slightly stronger position.

Sterling achieved a seven-week high against the Euro yesterday and advanced on a number of its other rivals as speculation surrounding the BoE document began to mount.

In the opinion of Commerzbank analysts; ‘Last week the release of unemployment data showed that the economy is growing at a rapid pace. Investors will be looking for any signs that the Monetary Policy Committee will change their stance regarding the level of spare capacity in the economy.’

Meanwhile, the New Zealand Dollar achieved a two-week high against its Australian counterpart during the local session as investors digested below estimate inflation figures for Australia.

If inflation had accelerated beyond the Reserve Bank of Australia’s 2-3 per cent target it would have supported the case for the central bank increasing interest rates and boosted the ‘Aussie’.

However, Australia’s consumer price index climbed by 2.9 per cent in the first quarter, year-on-year, rather than the 3.2 per cent anticipated.

The result saw the Australian Dollar tumble against peers like the US Dollar, Pound and ‘Kiwi’.

In the view of foreign exchange strategist Sam Tuck; ‘The RBA will be quite comfortable on neutral, thus the Australian Dollar got a little hammered. Australia’s CPI was lower than expected, and we saw the NZD to AUD go higher’.

As China is one of New Zealand’s main trading partners, the fact that the Asian nation’s manufacturing report showed a modest slowing in the pace of contraction gave the ‘Kiwi’ a little boost overnight.

China’s HSBC manufacturing PMI came in below the 50 mark separating growth from contraction in April, but the reading of 48.3 was a two-month high and up from 48.0 the previous month.

HSBC economist Hongbin Qu issued the following statement with the figures; ‘The HSBC Flash China Manufacturing PMI stabilised at 48.3 in April […] Domestic demand showed mild improvement and deflationary pressures eased, but downside risks to growth are still evident as both new export orders and employment contracted […] We think more measures may be unveiled in the coming months and the People’s Bank of China will keep sufficient liquidity’.

The New Zealand Dollar was also supported by the expectation that the Reserve Bank of New Zealand will announce an additional rate hike when it meets later today.

Investors have forecast that RBNZ Governor Graeme Wheeler will raise the official cash rate by a quarter-point, taking it to 3 per cent.

However, the prospect of a rate increase has been largely priced in to the market, so the GBP/NZD may only experience notable movement if the RBNZ surprises expectations.

New Zealand Dollar (NZD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

New Zealand Dollar, ,US Dollar,0.8589,

,US Dollar,0.8589,

New Zealand Dollar, ,Euro,0.6229,

,Euro,0.6229,

New Zealand Dollar, ,Australian Dollar,0.9193,

,Australian Dollar,0.9193,

New Zealand Dollar, ,Pound Sterling,0.5127,

,Pound Sterling,0.5127,

US Dollar, ,New Zealand Dollar,1.1637 ,

,New Zealand Dollar,1.1637 ,

Euro, ,New Zealand Dollar,1.6084 ,

,New Zealand Dollar,1.6084 ,

Australian Dollar, ,New Zealand Dollar,1.0799,

,New Zealand Dollar,1.0799,

Pound Sterling, ,New Zealand Dollar, 1.9572,

,New Zealand Dollar, 1.9572,

[/table]

Comments are closed.