With the festive season receding for another year and the markets starting to return to normal, the Euro began European trading in a bit of a downtrodden position against several of its major rivals.

On Tuesday the US Dollar was supported by an unexpectedly strong sentiment report and the EUR/USD pairing continues to trade lower as a result.

The common currency also began the day slightly softer against the Pound as speculation that the UK’s buoyant housing market will help bolster economic growth in 2014 pushed Sterling higher.

But the Euro went on to experience modest fluctuations as the Eurozone released a mixed bag of manufacturing data.

Although the French manufacturing sector was shown to have contracted by more-than-forecast in December, manufacturing PMI for Germany modestly exceeded initial estimates and PMI for the Eurozone edged up from 51.6 to 52.7.

This result means that manufacturing in the currency bloc expanded at the most significant pace for two and a half years in the fourth quarter.

Accompanying the figures was this statement from Markit economist Chris Williamson; ‘A strengthening upturn in the manufacturing sector is helping the Euro area recovery become firmly established. The latest numbers are consistent with production growing at a quarterly rate of approximately 1% at the end of the year. It’s also encouraging to see prices rising slightly, suggesting firms are seeing some improvement in pricing power’.

However, the 47.0 reading for France (which was down from 48.4 in November and worse than the 47.1 level previously forecast) is worrying, particularly given the fact that France is the Eurozone’s second largest economy.

However, the 47.0 reading for France (which was down from 48.4 in November and worse than the 47.1 level previously forecast) is worrying, particularly given the fact that France is the Eurozone’s second largest economy.

As Williamson also noted; ‘France, however, remains a concern. While Germany, Italy and Spain are seeing the strongest output growth since early-2011, buoyed to varying degrees by improved export sales, France is seeing a steepening downturn, in part the result of widening export losses. This suggests that competitiveness is a key issue which the French manufacturing sector needs to address to catch up with its peers.’

After the data was published the Euro continued to trade lower against the Pound as the British currency was supported by domestic manufacturing news.

Although UK manufacturing PMI fell from 58.1 to 57.3 in December rather than advancing to 58.2 as expected, a ninth month of expansion in the sector helped Sterling edge higher against its rivals.

While the EUR/USD pairing could experience additional movement as a result of today’s US initial jobless claims and ISM manufacturing reports, further EUR/GBP fluctuations may be limited ahead of tomorrow’s UK construction figures.

A disappointing Chinese non-manufacturing report could also lower the appeal of higher-risk assets like the Euro overnight.

Current Euro (EUR) Exchange Rates

< Lower > Higher

The Euro/US Dollar Exchange Rate is currently in the region of: 1.3724 <

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8293 <

The Euro/Australian Dollar Exchange Rate is currently in the region of: 1.5443 <

The Euro/ New Zealand Dollar Exchange Rate is currently in the region of: 1.6779 <

The US Dollar/Euro Exchange Rate is currently in the region of: 0.7287 >

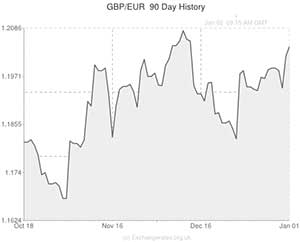

The Pound Sterling /Euro Exchange Rate is currently in the region of: 1.2055 >

The Australian Dollar/Euro Exchange Rate is currently in the region of: 0.6476 >

The New Zealand Dollar/Euro Exchange Rate is currently in the region of: 0.5964 >

(Correct as of 10:15 GMT)

Comments are closed.