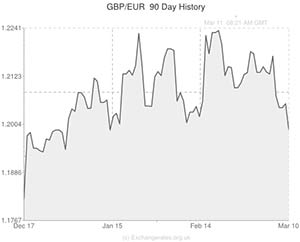

For the first time in a month, the Pound to Euro exchange rate (GBP/EUR) tumbled below significant psychological support at 1.2000 yesterday.

Sterling’s 60-pip contraction against the single currency came as demand for the Euro remained buoyant following last week’s decision from the European Central Bank not to introduce any further methods of monetary easing. GBP/EUR came close to 1.2200 during last week’s session as markets prepared for the ECB’s policy statement, in which it was anticipated that President Mario Draghi would release around €175 billion of ‘sterilized’ SMP funds into the Eurozone banking sector to boost liquidity, drive down lending costs and send CPI inflation higher.

However, Draghi and his Governing Council at the ECB commented that inflation expectations were sufficiently anchored towards the Bank’s 2.0% target in the medium term, and decided not to loosen policy at this juncture. The neutral decision, in place of dovish action, caused investors to pile back into the single currency and it was a continuation of this positive sentiment that took GBP/EUR below 1.2000 yesterday.

Sterling was also negatively impacted by news that an unnamed Bank of England official has been suspended in relation to a scandal involving the rigging of foreign exchange rates at the Bank. The reputation damaging news may not have had a significant impact, but it is likely to have contributed to the Pound’s losses.

Another news item related to the BoE that dampened demand for Sterling was Bank of England policymaker Charlie Bean’s speech to business owners in Darlington. Bean warned that rate rises may be delayed if the value of Sterling continues to increase because an overvalued Pound could impact Britain’s ability to develop into an export-driven economy:

“Any further appreciation of Sterling, which has risen almost 10% in trade-weighted terms since [last] March, would not be particularly helpful in terms of facilitating a rebalancing towards net exports”.

It is difficult to ascertain how much of an impact Bean’s comments had on GBP/EUR because the BoE man did temper his dovish remarks with the acknowledgement that the Pound’s current value was not considered to be a problem.

Sterling’s fortunes could change later this morning if the latest Industrial Production report prints optimistically at 3.0% inline with economists’ forecasts. A score of this vigour would represent the second best annual factory output reading since mid-way through 2011, and would most likely bolster demand for the Pound as Q1 GDP estimates improve. Manufacturing Production is also expected to impress, with markets pricing in a score of 3.3%.

If the Production figures meet the market consensus it is possible that Sterling could rally back above 1.2000.

Comments are closed.