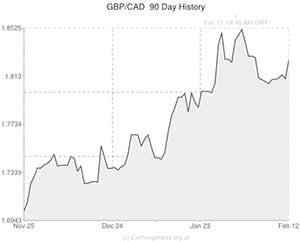

This week’s better-than-forecast UK retail sales data and the Bank of England’s upbeat inflation report helped the Pound rally against the majority of its peers.

The British asset posted a notable gain against the US Dollar and advanced on the ‘Loonie’ even as the Canadian currency received underlying support from last week’s surprisingly buoyant domestic employment data.

After a BoE official stated that it was reasonable to expect interest rates to be increased next year Sterling surged to a 2 ½ year high against the US Dollar and extended gains against a fairly static Canadian Dollar.

The ‘Loonie’ was little changed following the release of Canada’s new housing price index.

The report showed that house prices climbed by 0.1 per cent in December, month-on-month, as forecast by economists.

On the year the new housing price index showed a 1.3 per cent advance in December, down from 1.4 per cent in November.

The year-on-year advance was the smallest since early 2010 and supports the comment issued by the Bank of Canada last month regarding the housing market experiencing a ‘soft landing’.

As Canada relies heavily on the US for trade the news that US retail sales declined unexpectedly in January also reduced the ‘Loonie’s appeal.

However, the commodity-driven currency received some support as investors bet that the asset’s recent declines were excessive and the prospect of a budget surplus lowered rate cut fears.

Yesterday Canadian Finance Minister Jim Flaherty asserted that Canada would return to surplus next year.

According to forex strategist Daniel Katzive; ‘The market got very bearish on the Canadian dollar early this year – the rates market started to price in the risk of policy easing. What we expect is that the Bank of Canada is going to be on hold this year. Ultimately, the next move is a rate hike.’

The price of crude oil, a major Canadian export, achieving a four-month high also limited Canadian Dollar losses.

Before the week comes to an end UK construction output figures and Canadian manufacturing shipments data could affect the GBP/CAD exchange rate.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5465,

,Pound Sterling,0.5465,

Canadian Dollar, ,US Dollar,0.9088,

,US Dollar,0.9088,

Canadian Dollar, ,Euro,0.6646,

,Euro,0.6646,

Canadian Dollar, ,Australian Dollar,1.0128,

,Australian Dollar,1.0128,

Canadian Dollar, ,New Zealand Dollar,1.0895 ,

,New Zealand Dollar,1.0895 ,

US Dollar, ,Canadian Dollar ,1.1002 ,

,Canadian Dollar ,1.1002 ,

Pound Sterling, ,Canadian Dollar,1.8317,

,Canadian Dollar,1.8317,

Euro, ,Canadian Dollar,1.5052,

,Canadian Dollar,1.5052,

Australian Dollar, ,Canadian Dollar,0.9873,

,Canadian Dollar,0.9873,

New Zealand Dollar, ,Canadian Dollar,0.9174,

,Canadian Dollar,0.9174,

[/table]

Comments are closed.