The Canadian Dollar strengthened against the Pound on Thursday after the currency received support from a better-than-expected balance of trade report.

Earlier in the session Sterling came under pressure from a worse-than-expected Services PMI report. The data released by Markit showed that the UK’s dominant service sector saw its rate of expansion slow to its lowest-level since June last year. The PMI came in at 57.6 for March, down from February’s figure of 58.2. Economists had been forecasting for a rise to 58.9.

The Canadian Dollar meanwhile advanced against a number of its major peers after a report showed that the North American nation posted its first trade surplus in five months.

According to Statistics Canada, the trade surplus came in at C$290 million in February. In the first month of the year the nation posted a trade deficit of C$340 million. The surplus figure was better than the C$ 200 million economists had been expecting.

The surplus was a result of increased exports which rose by 3.6%. Imports also increased by 2.1%.

Despite the surplus being an encouraging sign that exports were improving economists were quick to point out that the rise was not that significant. Last month Canadian Central Bank Governor Stephen Poloz said that there was no evidence that the weaker ‘Loonie’ was having a positive impact on exports.

The Canadian currency is likely to experience further movement on Friday due to the release of anticipated employment data. The USA is also due to release unemployment data which investors will be using to gauge the health of the world’s largest economy.

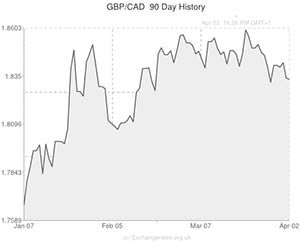

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5471 ,

,Pound Sterling,0.5471 ,

Canadian Dollar, ,US Dollar,0.9081 ,

,US Dollar,0.9081 ,

Canadian Dollar, ,Euro,0.6612 ,

,Euro,0.6612 ,

Canadian Dollar, ,Australian Dollar,0.9826,

,Australian Dollar,0.9826,

[/table]

Comments are closed.