On Friday commodity-driven currencies enjoyed a rebound and the ‘Loonie’ advanced on several of its major peers.

Bets that raw material prices have bottomed out helped the Canadian, Australian and New Zealand Dollars rally at the close of last week, even as the price of crude oil fell to a one-month low.

However, while the ‘Loonie’ was able to strengthen against a broadly softening Pound early in the European session, comments issued by the Canadian Finance Minister soon saw a reversal in the CAD/GBP paring.

A slightly disappointing services PMI report for the UK and hints that the nation may have to introduce further spending cuts weighed on Sterling as local trading got underway and the Canadian Dollar posted a modest advance.

However, the ‘Loonie’ was also feeling the pressure and quickly gave up gains as the details of an interview with Finance Minister Jim Flaherty were circulated.

As well as asserting that the CAD/USD pairing trading in ‘the nineties somewhere’ is good for Canadian manufacturing, Flaherty also stated; ‘The governor was with us recently with the provincial ministers and he indicated there might be some softening in the [Canadian] Dollar.’

In reference to Canada’s budget surplus for 2015-2016, Flaherty noted; ‘Yes, we’ll balance and it won’t be close, we’re in good shape. We could have a larger surplus than we anticipated but we will have a surplus.’

Meanwhile, Canadian data showed a larger-than-forecast drop in the raw materials price index and an unexpected gain in domestic industrial product price.

The raw materials price index fell 4.1 per cent in November, month-on-month, rather than dipping the 1.8 per cent expected.

Tomorrow CAD/GBP movement could be inspired by Canada’s Ivey Purchasing Managers Index for December. The measure came in at 53.7 in November, above the fifty mark separating growth from contraction.

In the latter half of the week movement may be triggered by the Bank of England’s rate decision, Canadian housing starts/new housing price index, UK construction/industrial/manufacturing output figures and Canadian unemployment data.

We forecast that the Pound could slide in the days ahead as the BoE refrains from altering stimulus and stresses the economic challenges still to be tackled.

If Canada’s employment figures show the improvement expected the ‘Loonie’ could end the week in a stronger position against the Pound.

Current Canadian Dollar (CAD) Exchange Rates:

< Down > Up

The Canadian Dollar/US Dollar Exchange Rate is currently in the region of: 0.9385 <

The Canadian Dollar /Euro Exchange Rate is currently in the region of: 0.6889 <

The Canadian Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5722 <

The Canadian Dollar/Australian Dollar Exchange Rate is currently in the region of: 1.0480 <

The Canadian Dollar /New Zealand Dollar Exchange Rate is currently in the region of: 1.1462 <

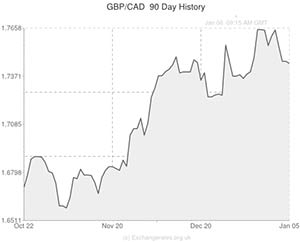

The Pound Sterling/Canadian Dollar Exchange Rate is currently in the region of: 1.7473 >

The US Dollar/ Canadian Dollar Exchange Rate is currently in the region of: 1.0675 >

The Euro/Canadian Dollar Exchange Rate is currently in the region of: 1.4511 >

The New Zealand Dollar/Canadian Dollar Exchange Rate is currently in the region of: 0.8800 >

The Australian Dollar/Canadian Dollar Exchange Rate is currently in the region of: 0.9542 >

(Correct as of 14:45 GMT)

Comments are closed.