A slightly disappointing business optimism report for the UK left the Pound a little weaker against peers like the US Dollar and Euro during European trading.

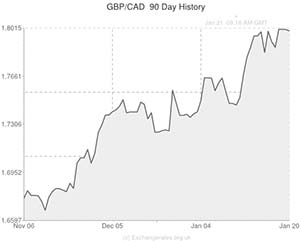

However, the British asset was able to consolidate and extend gains against a floundering ‘Loonie’ as investors focused on tomorrow’s Bank of Canada rate decision.

Expectations that the central bank will adopt a dovish tone in its policy statement pushed the Canadian Dollar below 91 cents against the US Dollar early into the North American session and caused the ‘Loonie’ to weaken against the Pound.

Given that economic indicators for Canada have hardly been encouraging in recent weeks, the BOC stopped hinting at potential interest rate increases in November and the odds of the Bank introducing a rate cut have been rising.

In the mind of one senior economist; ‘The bank’s biggest concern is persistently low inflation, and we expect that will be stressed even more firmly in the statement and the MPR inflation forecast will be downgraded. That dovish tone on inflation is also important from a currency perspective. Governor Poloz can’t be anything but pleased with the Loonie’s recent weakness. So, the statement will try to be as dovish as possible, stopping short of signalling potential [interest rate] cuts, in order to ensure the C$ doesn’t retrace some of its recent decline’.

Less-than-impressive domestic wholesale sales data also piled pressure on the Canadian Dollar today.

Wholesale sales stagnated in November rather than climbing by 0.3 per cent as expected. October’s month-on-month gain was negatively revised to 1.2 per cent.

Canadian manufacturing shipments, on the other hand, increased by 1.0 per cent in November – better than the 0.3 per cent gain forecast – although October’s gain was also negatively revised.

The CAD/USD declines were aided by a report in the Wall Street Journal which indicated that the Federal Reserve does plan to taper stimulus at its upcoming meeting.

As strategist David Tulk notes; ‘The impression these two central banks are going in opposite directions really takes the stuffing out of the Canadian Dollar. The next logical step is for the bank to adopt an outright easing bias. Instead of the long-held view that the next move by the Bank of Canada would be up, that it would be down.’

The Pound also received some support from the news that the Confederation of British Industries gauge of investment intentions climbed in the fourth quarter, advancing from minus 20 to minus 1.

A quarterly measure of new orders climbed from 6 to 13 – the best reading for nearly three years.

However, Canadian Dollar declines were slightly limited as the price of Brent oil (a major Canadian export) rose for the first time in four days.

With UK employment data due out before the Bank of Canada’s rate decision, extensive GBP/CAD fluctuations are likely.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5536,

,Pound Sterling,0.5536,

Canadian Dollar, ,US Dollar,0.9119 ,

,US Dollar,0.9119 ,

Canadian Dollar, ,Euro,0.6737 ,

,Euro,0.6737 ,

Canadian Dollar, ,Australian Dollar,1.0354,

,Australian Dollar,1.0354,

Canadian Dollar, ,New Zealand Dollar,1.1057 ,

,New Zealand Dollar,1.1057 ,

US Dollar, ,Canadian Dollar ,1.0963 ,

,Canadian Dollar ,1.0963 ,

Pound Sterling, ,Canadian Dollar,1.8055 ,

,Canadian Dollar,1.8055 ,

Euro, ,Canadian Dollar,1.4876,

,Canadian Dollar,1.4876,

Australian Dollar, ,Canadian Dollar,0.9661,

,Canadian Dollar,0.9661,

New Zealand Dollar, ,Canadian Dollar,0.9128 ,

,Canadian Dollar,0.9128 ,

[/table]

Comments are closed.