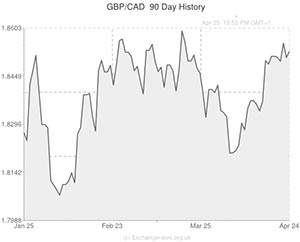

While the Pound slipped against the US Dollar and Euro on Friday, it maintained a comparatively bullish relationship with a static Canadian Dollar.

Yesterday the commodity-driven currency was modestly boosted as Stephen Poloz, Governor of the Bank of Canada, delivered his ‘Canada’s Hot – and Not – Economy’ speech.

In the speech Poloz stressed the adverse impact of weak business spending and the necessity of boosting this aspect of the economy.

Poloz asserted; ‘What I really think we are observing is a high level of self responsibility through this. [People] don’t want to over-extend themselves […] The downturn that we went through wasn’t just a matter of companies cutting back on production and then waiting for the recovery to come. A number of companies just couldn’t last. It’s more like a post-crisis repair job for the economy as opposed to a classic recovery.’

Poloz also intimated that interest rates will be at lower levels for the foreseeable future, and that the weaker Canadian Dollar exchange rate will benefit Canadian manufacturers.

His relatively upbeat export outlook meant that the ‘Loonie’ was slightly stronger after the speech.

But the Canadian currency pared these gains on Friday amid increasing concerns regarding the situation in Ukraine.

While market movement in general was fairly stilted, the Pound to Canadian Dollar (GBP/CAD) pairing was stronger after UK retail sales figures showed an unexpected increase in March.

The 0.1 per cent increase in retail sales including autos trumped expectations for a 0.4 per cent decline.

The Canadian Dollar also softened as the price of oil, a major Canadian commodity, dipped after Standard & Poor’s cut Russia’s credit rating.

During the North American session the US Dollar fluctuated slightly as data showed that the pace of expansion in the US services sector slowed unexpectedly.

The Markit services PMI slid from 55.3 to 54.2 rather than advancing to 55.5.

However, the US University of Michigan Confidence gauge jumped from 82.6 to 84.1.

Next week Canada’s GDP and manufacturing figures will help drive ‘Loonie’ movement, with UK growth data being equally likely to inspire GBP to CAD fluctuations.

China’s manufacturing report could also affect the commodity-driven currency and investors will be paying close attention to Friday’s US non-farm payrolls report.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5394,

,Pound Sterling,0.5394,

Canadian Dollar, ,US Dollar,0.9074,

,US Dollar,0.9074,

Canadian Dollar, ,Euro,0.6552,

,Euro,0.6552,

Canadian Dollar, ,Australian Dollar,0.9775,

,Australian Dollar,0.9775,

Canadian Dollar, ,New Zealand Dollar,1.0527,

,New Zealand Dollar,1.0527,

US Dollar, ,Canadian Dollar ,1.1020,

,Canadian Dollar ,1.1020,

Pound Sterling, ,Canadian Dollar,1.8527,

,Canadian Dollar,1.8527,

Euro, ,Canadian Dollar,1.5248,

,Canadian Dollar,1.5248,

Australian Dollar, ,Canadian Dollar,1.0234,

,Canadian Dollar,1.0234,

New Zealand Dollar, ,Canadian Dollar,0.9508,

,Canadian Dollar,0.9508,

[/table]

Comments are closed.