On Friday the ‘Loonie’ plummeted beyond 90 cents per US Dollar, but the commodity-driven currency went on to fluctuate against its major rivals in the aftermath of the publication of Canadian inflation data.

The nation’s consumer price index showed that inflation climbed in December, albeit by less than anticipated.

The CPI advanced by 1.2 per cent year-on-year, below forecasts for a 1.4 per cent gain but up from November’s annual advance of 0.9 per cent.

Monthly CPI fell by 0.2 per cent, as expected.

According to senior economist Krishen Rangasamy; ‘Over all, the inflation picture remains very mild in Canada as evidenced by the three-month annualised core rate of just 0.7 per cent. For 2013 as a whole, the annual inflation rate was 0.9 per cent, the lowest since the 2009 recession, and the second lowest since 1994.’

The Canadian Dollar recovered some ground against its US rival as the data was digested, although gains were limited.

Some industry experts have recently expressed hopes that ‘Loonie’ weakness will help boost inflation and support the Canadian economic recovery – although inflation isn’t expected to achieve the Bank of Canada’s target until at least late 2015.

Today the Canadian Dollar was struggling against peers like the Pound as the price of Brent crude oil, a major Canadian export, slumped with futures shedding as much as 0.7 per cent.

The price of oil stumbled as last week’s disappointing manufacturing report for China and the selloff in emerging market currencies took a toll.

Market analyst Michael Hewson said of the situation; ‘The uncertainty in emerging markets will see demand in those economies slip back and even in the US there is uncertainty ahead of the Fed’s meeting this week. Oil hasn’t been as impacted by the volatility seen on other markets as there has been a bad weather premium holding it up, but that shouldn’t last much longer’.

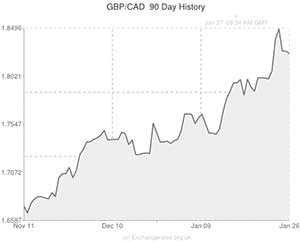

The Canadian Dollar’s decline against the Pound was exacerbated as the British currency received underlying support from expectations surrounding tomorrow’s UK growth data.

Sterling strengthened against several of its major peers and advanced close to a 2 ½ year high against the US Dollar as investors bet that the GDP report will confirm that the UK’s economy expanded in every quarter of 2013 – the first time the nation has posted a full year of increases since 2007.

In reference to the UK’s economic recovery, economist James Carrick noted; ‘There’s a natural momentum, there’s a self-reinforcing cycle, as credit comes back and people spend, profits rise, and companies hire more workers. The BoE has successfully broken the downward spiral in credit creation.’

If the report confirms that UK GDP expanded by 0.7 per cent in the fourth quarter following growth of 0.8 per cent in the third, the Pound could be buoyed in the days ahead.

The Canadian Dollar, meanwhile, could experience rather limited movement ahead of the conclusion of the Federal Reserve’s two-day policy meeting on the 29th.

While the commodity-driven currency was able to claw back losses against the ‘Buck’ today as US new home sales plummeted by 7.0 per cent, if the Fed trims stimulus by the five-billion Dollars expected the ‘Loonie’s bearish relationship with its US counterpart could continue.

Canadian data is in short supply this week, with only average weekly earnings figures due out before Friday’s more influential GDP report.

Canadian GDP is expected to have risen by 0.2 per cent in November, month-on-month, following growth of 0.3 per cent in October.

On the year the Canadian economy is forecast to have grown by 2.6 per cent.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5473,

,Pound Sterling,0.5473,

Canadian Dollar, ,US Dollar,0.9059 ,

,US Dollar,0.9059 ,

Canadian Dollar, ,Euro,0.6627,

,Euro,0.6627,

Canadian Dollar, ,Australian Dollar,1.0366,

,Australian Dollar,1.0366,

Canadian Dollar, ,New Zealand Dollar,1.0845 ,

,New Zealand Dollar,1.0845 ,

US Dollar, ,Canadian Dollar ,1.1036 ,

,Canadian Dollar ,1.1036 ,

Pound Sterling, ,Canadian Dollar,1.8292 ,

,Canadian Dollar,1.8292 ,

Euro, ,Canadian Dollar,1.5091,

,Canadian Dollar,1.5091,

Australian Dollar, ,Canadian Dollar,0.9653,

,Canadian Dollar,0.9653,

New Zealand Dollar, ,Canadian Dollar,0.9107 ,

,Canadian Dollar,0.9107 ,

[/table]

Comments are closed.