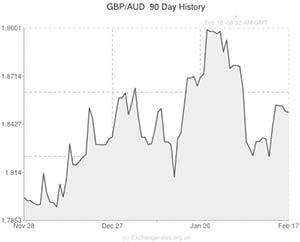

The Pound to Australian Dollar exchange rate sunk by around -0.6 cents to 1.8440 earlier this morning following the latest Minutes report from the Reserve Bank of Australia.

The ‘Aussie’ Dollar strengthened as the RBA reiterated that it is unlikely to ease monetary policy further, despite the fact that Australian GDP is expected to print below trend through 2014.

The Central Bank noted that economic indicators had been “more positive for economic activity around the turn of the year” and expects output to “strengthen a little” this year as the effects of past rate cuts continue to work their way though the real economy.

The domestic currency also benefitted from the RBA’s decision to drop comments about the exchange rate being too high. However, the Bank did mention that sustained declines in the ‘Aussie’ would help the nation adjust to a softening of mining activity.

The main event for GBP traders today is hotting up to be the Office for National Statistics’ latest CPI inflation report. Released later this morning, the report is predicted to show that the Consumer Price Index held steady at 2.0% during January, but there are concerns from some investors that inflation could slip lower due to aggressive discounting from retailers in the aftermath of the Christmas holidays.

CPI fell to the Bank of England’s 2.0% target during December following nearly four years of running higher, peaking at 5.2% during October 2011. If inflation falls below 2.0% it will mark the first time since November 2009 that the Bank’s target has been breached to the downside.

Following last week’s rapid gains across the board, Sterling corrected lower against most of its major currency peers yesterday: 1) in anticipation of a potential slowdown in UK CPI and 2) as traders looked to lock-in profits.

The Pound softened by around -0.4 cents against the Euro, -0.5 cents against the US Dollar, -0.7 cents against the Canadian Dollar and -0.2 cents against the New Zealand Dollar yesterday.

GBP/AUD declined slightly as the ‘Aussie’ was supported by strong lending data out of China. The world’s second largest economy posted a higher-than-expected jump in new loans during January, with Chinese financial institutions issuing 1.32 trillion Yuan worth of loans, up from just 482.5 billion Yuan in December. January’s impressive score marked the best monthly performance for four years. This benefitted the Australian Dollar because China is the largest importer of Australian goods and the large loan numbers suggests that Chinese firms are looking to expand, possibly by importing larger amounts of raw materials from Australia.

Comments are closed.