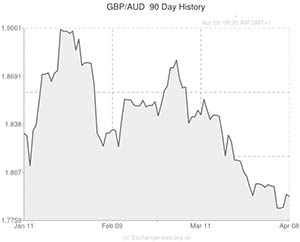

The Pound to Australian Dollar exchange rate (GBP/AUD) softened by around -0.2 cents earlier this morning in reaction to a slender rebound in the Australian Westpac Consumer Confidence indicator. On the whole GBP to AUD remained fairly flat yesterday.

Sterling had initially tumbled by around a cent to 1.7820 against the ‘Aussie’ on Tuesday but demand for the Pound surged in the morning in response to a trio of robust UK economic readings.

UK Industrial Production came in three times stronger-than-expected at 0.9% for February. On an annual basis Industrial output rose by 2.7%. The Manufacturing Production index rose by 1.0% on the month and a 3-year high of 3.8% on the year. The impressive ecostats caught traders off-guard and led to a bout of Sterling rallies across the board.

GBP/USD rose by 1.5 cents to reach a monthly high of 1.6755 and GBP/EUR appreciated by half a cent to strike a monthly high of 1.2146.

Demand for the Pound also improved in reaction to some decent UK GDP forecasts from the NIESR and the IMF.

The National Institute of Economic and Social Research (NIESR) released a report estimating that the British economy expanded by 0.9% during the first three months of the year. This rapid acceleration, if proved to be accurate when the official ONS data is released later this month, could potentially cause the Bank of England to bring forward the date of its first interest rate hike.

The International Monetary Fund (IMF) concurred with the NIESR that British Gross Domestic Product will be strong this year; the IMF upped its UK growth forecast for 2014 from 2.5% to 2.9%.

Whilst the Pound pushed ahead against the large majority of its currency rivals in reaction to this tripartite of encouraging domestic news, Sterling was unable to make any inroads against the stubborn Australian Dollar.

This may be due to the fact that markets no longer expect the Reserve Bank of Australia to cut interest rates any further this year: marking a shift in sentiment from January and February when rate reduction speculation was rife.

The ‘Aussie’ remained well supported during the night as Westpac’s Consumer Confidence index rebounded from -0.7% to +0.3% this month. April’s report was especially encouraging for families, with the family finance sub index up 6.7% compared to a year ago.

Data released later this morning could undermine demand for Sterling if the UK Visible Trade Balance comes in worse than the median forecast of -£9.2 billion. Whilst economic output indicators such as private sector PMI reports, labour market readings and GDP numbers have tended to impress recently, trade figures have had a nasty habit of disappointing. Another downbeat trade print this morning could send the Pound to Australian Dollar exchange rate (GBP/AUD) lower.

Comments are closed.