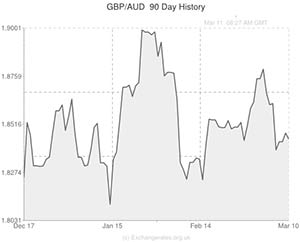

The Pound to Australian Dollar exchange rate (GBP/AUD) surged higher by over a cent last night as traders sold the commodity-sensitive currency in response to a mixture of soft Chinese output, Ukrainian/Russian related jitters and falling commodity prices.

With Chinese Exports down -18.1% in February, marking the worst performance since August 2009, the Chinese economy posted a trade deficit for only the fifth time in the last decade. The soft Chinese trade figures dampened demand for the ‘Aussie’ because they were seen to reflect badly on trade prospects between the two nations over the next few months.

This was especially damaging for AUD because China is the largest buyer of Australian exports (31%). In fact, Australia relies on Chinese demand for its raw materials and goods more than any other nation does.

Because of the tight financial regulation in China – strict capital controls and a state-managed exchange rate – many investors use Australia as a proxy for trading the Chinese dragon. As the world’s second largest economy with an average annual growth rate north of 7.0%, China can be very profitable to traders. However, investors often opt to place their funds in the China-correlated Australian economy to avoid the threat of having their assets frozen in the illiquid Chinese market.

With Federal Reserve tapering likely to continue in light of last Friday’s robust 175,000 US Non-farm Payrolls report, an absence of risk appetite has also worked against the Australian Dollar. Lingering concerns that the Russian/Ukrainian conflict in Crimea could yet prove to have a profound impact on financial markets has exacerbated this risk-off environment.

Risk aversion trends saw the S&P 500 post its second consecutive day of decline as commodity prices faltered. Because the Australian economy is heavily dependent on commodity extraction and mining, the Australian Dollar was subject to staunch selling pressures during the evening yesterday as copper (-2.6%), iron ore (-8.3%) and crude oil (-1.6%) prices all declined.

The ‘Aussie’ Dollar was troubled again just before midnight as Westpac’s survey of Australian Consumer Sentiment printed below 100.0 for the first time since May last year. The disappointing score of just 99.5 for March came as worries over the jobs market and mining sector weighed on consumer confidence.

The disappointing domestic dataset accentuated Sterling’s gains as the Pound to Australian Dollar exchange rate (GBP/AUD) completed a 1.3 cent rally from 1.8420 to 1.8550.

Comments are closed.