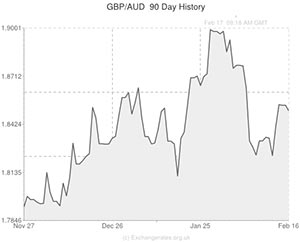

The Australian Dollar traded close to the highs it hit last week against the Pound and jumped to a one-month high against the US Dollar after data out of China increased demand for riskier assets.

The data out of China showed that lending growth in the world’s second largest economy hit a record high in January, a positive sign for Australia’s biggest trading partner and a sign that the Chinese economy’s growth momentum is continuing.

According to the Chinese Central Bank, financial institutions in the country issued 1.32 trillion Yuan ($217.8 billion) worth of new loans in January, a sharp increase from the 482.5 billion Yuan issued in December last year. The figure was also more than economists had forecast.

“The lending report allays concern about a slowing in economic growth as China is still a credit-driven economy. These numbers provide some confidence that growth is still ticking along, and are good for the ‘Aussie’, ‘Kiwi’ and emerging-market currencies,” said Ray Attrill, from National Australia Bank.

The ‘Aussie’ could have pushed higher in the Asian session after data out of Japan showed that the nation’s economy is struggling as total growth figures came in at just 1% on a yearly basis. Industrial production data in Japan also came in weaker-than-forecast.

The Pound meanwhile looks set to begin to make gains against the ‘Aussie’ throughout the session after the UK currency was bolstered by data which showed that house prices in the UK rose in February. As a result the Pound hit a four-year high against the US Dollar and reached its best level in a year against the Euro.

Australian Dollar (AUD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Australian Dollar, ,US Dollar,0.9037 ,

,US Dollar,0.9037 ,

Australian Dollar, , Pound Sterling,0.5397 ,

, Pound Sterling,0.5397 ,

Australian Dollar, ,Euro,0.6591 ,

,Euro,0.6591 ,

Australian Dollar, ,New Zealand Dollar,1.0796 ,

,New Zealand Dollar,1.0796 ,

Pound Sterling, ,Australian Dollar,1.8528 ,

,Australian Dollar,1.8528 ,

US Dollar, ,Australian Dollar,1.1064 ,

,Australian Dollar,1.1064 ,

Euro, ,Australian Dollar,1.5171 ,

,Australian Dollar,1.5171 ,

[/table]

Comments are closed.