Pound Sterling was trading firmer against the US Dollar on Monday as investors look ahead to the release of UK inflation data due tomorrow.

Earlier in the session the Pound was weakened by concerns over the UK’s housing market following comments made by Bank of England Governor Mark Carney.

Mr Carney warned that soaring house prices are the biggest threat to the UK economy after a report released by Rightmove Plc showed that prices climbed to yet another record high in May.

Across the country house prices leapt by 3.6%, the highest level for this time of year seen since 2002.

Average house prices now stand at the all time high of £272,003.

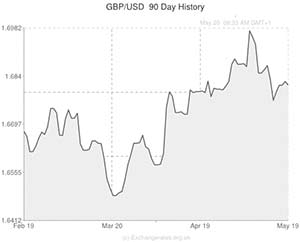

The Pound to US Dollar exchange rate is currently trading around 1.6832.

“The UK housing market has a deep structural issue that could undermine the economy and is negative for the Pound. It’s unlikely the Bank of England will use an interest rate increase as a policy tool to rein in the market unless as a last resort,” said a senior currency strategist from UBS AG.

Also putting some pressure upon the Pound was the deal between pharmaceutical companies AstraZeneca and Pfizer.

A merger between the two would have been one of the UK’s biggest ever takeovers but the merger now looks likely to fail after AstraZeneca rejected an offer from Pfizer.

The US Dollar meanwhile softened as it remains under pressure from concerns that the world’s largest economy is slowing down.

Last Friday saw the release of data which showed that consumer confidence in the USA fell in May.

Against the Japanese Yen the ‘Greenback’ fell to its lowest-level in three-months as demand for safe haven currencies rose in the wake of weaker than forecast data out of China and concerns over the situations in Ukraine and the South China Sea.

The main data for the US Dollar due on Tuesday is the Chain Store Sales reports. The data is unlikely to create much movement however as investors are looking ahead to Wednesday’s FOMC minutes and a speech due to be held by Federal Reserve Chairman Janet Yellen.

Pound to US Dollar Update – 20/05/14

The Pound reached a session high against the US Dollar after data out of the UK showed that inflation in the country rose at a faster rate than forecast in April.

The currency then eased off slightly as investors were concerned that the data shows that consumer price rises are increasing faster than wage growth.

The yearly rate of inflation increased from March’s level of 1.6% to 1.8% in April. The figure was better than economist forecasts for a rise to 1.7%.

The ONS also said that U.K. house prices rose by 8.0% in March from a year earlier, slowing from 9.2% in February. House prices in London jumped 17% in the last 12 month, it added.

With no major US data releases due today the Pound is likely to remain trading higher throughout the session.

Comments are closed.