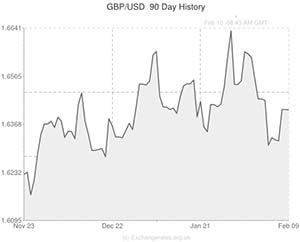

The Pound is close to its highest level in a week against the US Dollar after the GBP/USD pair breached the 1.64 level earlier in the session as economists raise their expectations that the Bank of England will raise interest rates sooner than forecast.

Sterling rose against the majority of its most traded peers on Monday ahead of the release of a report on Tuesday which is expected to show that retail sales in the UK climbed at a faster pace in January. If the figures do come in positively we can expect the Pound to further strengthen against the ‘Greenback’ and make gains against the Euro.

According to the British Retail Consortium, retail sales are expected to have risen by 0.8% last month, adding on to the 0.4% increase seen over the Christmas period.

The Bank of England is due to release its newest economic forecasts for economic growth and consumer prices when it releases its quarterly inflation report on Wednesday. Speculation that the Central Bank will raise interest rates has kept the Pound supported against its peers.

The US Dollar was mixed against its peers on a quiet day of trading due to a lack of domestic economic data releases. The main piece of data investors are watching is the first testimony of new Federal Reserve Chairman Janet Yellen. Economists are eager to see how she will react to the easing of the Central Bank’s monetary easing programme.

US Dollar (USD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Pound Sterling,0.6096 ,

,Pound Sterling,0.6096 ,

US Dollar, ,Euro,0.7333 ,

,Euro,0.7333 ,

US Dollar, ,Canadian Dollar,1.6456 ,

,Canadian Dollar,1.6456 ,

US Dollar, ,Australian Dollar,1.1190 ,

,Australian Dollar,1.1190 ,

[/table]

Comments are closed.