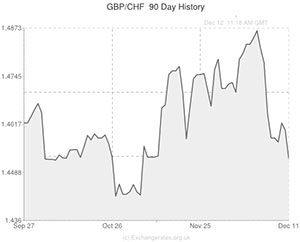

The Pound has firmed from a near-monthly low against the Swiss Franc after the Swiss National Bank chose to maintain interest rates at its final policy meeting of the year.

The Franc lost ground against a number of other currencies after the decision was announced. The US Dollar was able to edge away from a two-year low and the Euro firmed from a seven-month low as the Swiss National Bank warned that it would keep intervening in the foreign exchange markets to keep the Franc weak and to defend the currency’s 1.20 Francs peg to the Euro.

The SNB said that it was maintaining the minimum exchange rate on the franc at 1.20 per euro and its benchmark interest rate unchanged at zero, as widely expected. According to the Central Bank’s policy makers the Swiss franc is “still high”.

The Bank also said that it had not changed its forecasts for the current and coming years and predicts that economic growth in the country will improve by between 1.5% and 2.5% for 2013. Next year it predicts that the Swiss economy will see expansion of around 2%.

The (SNB) statement sounded cautious on the GDP outlook in the very near term. All that may seem a tad dovish relative to market expectations going into the meeting,” said Valentin Marinov, currency strategist at Citi.

As the Eurozone continues to disappoint, Switzerland is vulnerable to the economic situation abroad, downside risks still prevail for Switzerland.

Current Swiss Franc (CHF) Exchange Rates

Swiss Franc/ Euro Exchange Rate is currently in the region of: 0.8194

Swiss Franc/US Dollar Exchange Rate is currently in the region of: 1.1284

Swiss Franc/ Pound Sterling Exchange Rate is currently in the region of: 0.6882

Swiss Franc/ Australian Dollar Exchange Rate is currently in the region of: 1.2466

(Correct as of 11:40 am GMT)

Comments are closed.