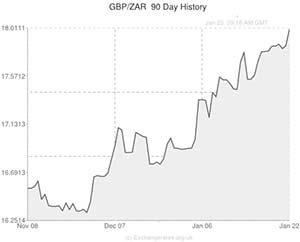

The Rand fell against the Pound and tumbled close to a five-year low against the US Dollar as workers in South Africa’s mining sector went on strike.

Negative strike-related headlines, coupled with pressure on commodity currencies in general from data pointing to slowing demand from key trading partner China, could see the Rand surpass last week’s low and could send it to its lowest point since October 2008.

The strike over pay lunched by the AMCU trade union is disrupting operations at the nation’s biggest mines and could see Platinum production, (which accounts for 70% of the world’s supply) fall. The strike is the biggest one held since the 2012 Marikana massacre in which 34 miners were shot dead by security forces. The union has threatened that workers will down tools indefinitely until their demands are met.

Some pressure was eased after a proposed strike in the nations’ gold mines was called off following a court ruling.

“Not all is right with the world of the Rand. For the first time in a week local demand outweighed international supply and this trend is likely to continue as we approach the domestic month-end next week,” said Warrick Butler, a trader at Standard Bank.

The AMCU is demanding that its members receive a living wage which is double what they currently earn. The mining companies however have said that they cannot afford to pay for such an increase due to high production costs and weakening demand.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.1515 ,

,South African Rand,18.1515 ,

Euro, ,South African Rand,14.9129 ,

,South African Rand,14.9129 ,

US Dollar, ,South African Rand,10.9395 ,

,South African Rand,10.9395 ,

Australian Dollar, ,South African Rand,9.6311 ,

,South African Rand,9.6311 ,

[/table]

Comments are closed.