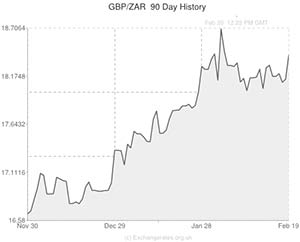

The South African Rand is trading close to a two-year low against the Pound and plunged beyond the key psychological 11 R level against the US Dollar as unrest in the Ukraine and Thailand piled further pressure upon emerging market currencies.

Emerging market currencies fell after the US Federal Reserve’s policy meeting minutes suggested that policymakers will choose to press on with tapering its quantitative easing programme regardless of the turmoil hitting currencies like the Rand.

A strike in South Africa’s platinum industry saw 4.4 billion Rand worth of revenue lost as it drags on into a fourth week. Weak data out of China which suggests that the world’s second largest economy and one of South Africa’s biggest buyers of exports is slowing. According to Markit/HSBC China’s Purchasing Managers Index (PMI) tumbled to a seven-month low of 48.3 in February and was down from January’s figure of 49.5. It also showed that employment fell at its fastest pace in five years. Any figure below 50 indicates a contraction.

Sentiment towards riskier currency’s received a further hit as violence erupted in Ukraine which left over 30 dead. Ongoing street battles between protestors and police have turned Kiev into a war zone and fears are growing that the country is sliding into civil war. Violent protests in Thailand also escalated, leaving several people dead also.

“While sentiment towards emerging markets has worsened, it is too early, and sentiment is not yet strong enough, to know if this is enough to generate another flare up of EM panic – but risks have grown,” said Rand Merchant Bank strategist John Cairns.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.4406,

,South African Rand,18.4406,

Euro, , South African Rand ,15.0872 ,

, South African Rand ,15.0872 ,

US Dollar, ,South African Rand,11.0715 ,

,South African Rand,11.0715 ,

Australian Dollar, ,South African Rand,9.9017 ,

,South African Rand,9.9017 ,

[/table]

Comments are closed.