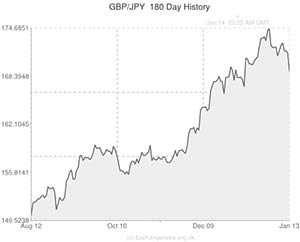

The Japanese Yen has fallen against the Pound reversing the gains it made on Monday and has tumbled back to a five-year low against the US Dollar after a report showed that Japan’s current account deficit hit a record in November.

The weak Yen has been blamed for the figure as it has pushed up the cost of imports. An increase in the demand for energy due to the closure of the nation’s nuclear power stations in the wake of Fukishima crisis also weighed heavily.

According to the Tokyo based Ministry of Finance the deficit leapt to ¥592.8 billion, the largest deficit recorded since 1985. The data calls into question the effectiveness of Prime Minister Shinzo Abe’s plan (nicknamed ‘Abenomics’) to boost the Japanese economy.

The Yen weakened further following the data’s publication as concerns grow among investors that Japan could end up becoming a deficit nation which would need funding from other nations to pay off a debt burden that is more than twice the size of the nation’s entire economy.

“We have to take this problem seriously and solve the underlying causes. Japan would have to depend on foreign investment to finance its budget shortfall if it allows its current-account balance to remain in deficit,” said Akira Amari, Japan’s Economy Minister.

Currently due to high exports Japan is in a surplus but that could easily change due to ongoing political tensions with its biggest trading partner and rival, China.

Current Japanese Yen (JPY) Exchange Rates:

< Down > Up

The US Dollar/Japanese Yen Exchange Rate is currently in the region of: 103.6420 >

The Pound Sterling/Japanese Yen Exchange Rate is currently in the region of: 170.2100 >

The Euro/Japanese Yen Exchange Rate is currently in the region of: 141.8039 >

The New Zealand Dollar/Japanese Yen Exchange Rate is currently in the region of: 87.0659 >

The Australian Dollar/Japanese Yen Exchange Rate is currently in the region of: 93.2730 <

(Correct as of 11:30 am GMT)

Comments are closed.