While the Euro was little affected by yesterday’s German import price index, the common currency did slide against the Pound during European trading on Tuesday as Sterling was supported by better-than-expected domestic mortgage loan applications data.

UK mortgage approvals advanced to a four-year high in November, with the number of new mortgages approved climbing to 45,000 last month from a revised 43,000 the previous month.

The result was better than the 44,500 figure expected.

Market fluctuations might be restricted this week as investors consolidate their positions before the winter break, but economists are still giving the Euro a bearish-neutral short term outlook as inflation/negative interest rate concerns piling pressure on the common currency.

Meanwhile, a report published this morning showed that French consumer spending rose last month, climbing 1.4 per cent as a result of increasing energy bills.

The Euro softened slightly against the US Dollar as the North American currency recovered ground ahead of today’s US durable goods orders data. Yesterday’s University of Michigan index may have disappointed expectations but economists are hoping that today’s report will show an increase of 1.3 per cent in durable goods orders in November following a decline of 2.0 per cent in October.

US new home sales figures will also be of interest.

That being said, although several influential economic reports for Japan are scheduled for publication this week the Christmas season has limited other data releases, leaving currency market movement restrained.

New Year celebrations will be a cause of disruption next week, but the Euro can be expected to break out of its current narrow trading range as a result of several European reports, including Spanish retail sales figures, Italian business confidence, Portuguese retail sales/industrial production, Spanish/German/Eurozone manufacturing PMI, German retail sales data and the Eurozone inflation rate report.

Signs that the Eurozone ended the fourth quarter on a high following slowing growth in the third quarter could give the Euro a boost as 2013 comes to a close.

Current Euro (EUR) Exchange Rates

< Lower > Higher

The Euro/US Dollar Exchange Rate is currently in the region of: 1.3673 <

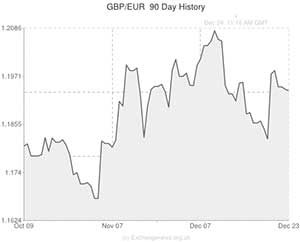

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8367 <

The Euro/Australian Dollar Exchange Rate is currently in the region of: 1.5327 <

The Euro/ New Zealand Dollar Exchange Rate is currently in the region of: 1.6714 >

The US Dollar/Euro Exchange Rate is currently in the region of: 0.7313 >

The Pound Sterling /Euro Exchange Rate is currently in the region of: 1.1951 >

The Australian Dollar/Euro Exchange Rate is currently in the region of: 0.6524 >

The New Zealand Dollar/Euro Exchange Rate is currently in the region of: 0.5980 <

(Correct as of 11:10 GMT)

Comments are closed.