The Australian Dollar is close to hitting its highest level in a month against the Pound and surged to its highest level of the year so far against the US Dollar as it continued to find support from strong domestic data and shrugged off comments made by RBA governor Glenn Stevens.

The ‘Aussie’ has soared by almost 2% this week as a run of positive data bolstered demand for the currency and an easing of tensions between Ukraine and Russia saw demand for perceived riskier assets climb. Recent retail sales, building approvals and economic growth reports have all come in strongly.

“Australia is almost starting to look like it’s going from gloom to boom. That may be a bit premature, but the run of mostly positive data over the past week indicates that the economy is weathering the mining investment slump well,” said AMP’s chief economist.

The currency found further support after RBA Governor Glenn Stevens reasserted that the Central Bank will keep interest rates on hold for the foreseeable future. The ‘Aussie’ did dip slightly however after he said that the exchange rate was “high by historical” standards. Economists widely shrugged off those words and sent the currency back higher.

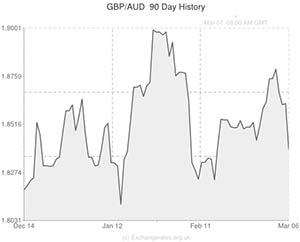

The ‘Aussie’ pushed higher against the Pound after the Bank of England made no change to interest rates or its quantitative easing programme. With a lack of domestic data for the UK the currency received little in the way of support.

Today the Australian Dollar is likely to see some volatility if the latest nonfarm payrolls data out of the USA comes in strongly. If it does come in above forecasts than speculation will increase that the Federal Reserve could increase the pace of the tapering of its quantitative easing programme.

Australian Dollar (AUD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Australian Dollar, ,US Dollar,0.9119 ,

,US Dollar,0.9119 ,

Australian Dollar, ,Euro,0.6570 ,

,Euro,0.6570 ,

Australian Dollar, ,Pound Sterling,0.5442 ,

,Pound Sterling,0.5442 ,

Australian Dollar, ,New Zealand Dollar,1.0726 ,

,New Zealand Dollar,1.0726 ,

[/table]

Comments are closed.