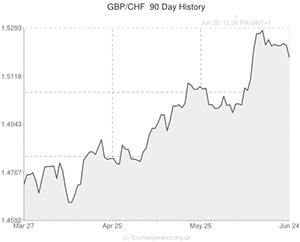

The Pound initially slumped to its lowest level in two-weeks against the Swiss Franc on Wednesday as yesterdays comments by Bank of England Governor Mark Carney dampened investor expectations for an early interest rate hike and as concerns over Iraq bolstered demand for safe haven currencies.

As news filtered in that Syrian warplanes launched attacks in western Iraq against Sunni militants concerns grew that the conflict in Iraq could escalate and spread further across the Middle East.

The airstrikes are thought to have killed over 50 people.

With Syria now getting involved in the fighting it raises the prospect of Iran involving itself further as well.

The US dispatched 300 Special Forces personnel to aid the Iraqi government fight back.

US Secretary of State John Kerry, meanwhile, urged Kurdish leaders to back the Iraqi government in its fight against militants storming across the country and to support the formation of a new national government in Baghdad by July.

As a result of the escalation in the crisis the Pound dropped to a two-week low of 1.5142 against the Swiss Franc.

The Pound was also weakened against the US Dollar amid speculation that the currency’s recent rally to a five-year high was overdone.

“The rally in Sterling looked a little excessive above $1.70. The market is re-pricing a little the degree of certainty it had over bringing forward rate-hike expectations. There may be also concern that if we are going to see macro-prudential measures announced tomorrow, it might mitigate the impact of rate increases,” said the head of currency at Canadian Imperial Bank of Commerce.

As the session progressed the Pound managed to regain some ground against the Franc as market attention turned to the release of US economic data which is expected to show just how damaging the winter’s harsh weather was to the world’s largest economy.

Updated 09:40 GMT 26 June, 2014

Pound Sterling to Swiss Franc (GBP/CHF) Exchange Rate Stronger before Stability Report

As European trading kicked off on Wednesday the Pound Sterling to Swiss Franc (GBP/CHF) exchange rate was holding onto yesterday’s gains.

The pairing was 0.11% stronger ahead of the release of the UK’s Financial Stability report as investors moved their focus from Tuesday’s dovish Bank of England comments.

However, if the BoE should choose to reference the increased level of slack in the UK economy today, the Pound to Swiss Franc (GBP/CHF) exchange rate could drop back toward the two-week low seen on Tuesday.

Additional market movement could be caused by news from the US, including personal spending figures.

Current Swiss Franc (CHF) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Swiss Franc, ,US Dollar,1.1189 ,

,US Dollar,1.1189 ,

Swiss Franc, ,Pound Sterling,0.6590 ,

,Pound Sterling,0.6590 ,

Swiss Franc, ,Euro,0.8221 ,

,Euro,0.8221 ,

Euro, , Swiss Franc,1.2165 ,

, Swiss Franc,1.2165 ,

Pound Sterling, , Swiss Franc,1.5176 ,

, Swiss Franc,1.5176 ,

[/table]

Comments are closed.