The Pound posted gains against both the Australian Dollar and the New Zealand Dollar over the weekend as markets reacted to the escalating situation in Ukraine.

Russian forces have already seized the Ukrainian peninsula of Crimea and, despite calls from US President Barack Obama to back down, Russian President Vladimir Putin declared over the weekend that he has the right to invade Ukraine to protect Russian nationals living in the neighboring country.

The conflict has already taken many lives in the Ukrainian capital of Kiev and now looks to be Moscow’s biggest confrontation with the West since the Cold War.

Traders of the risk-sensitive ‘Aussie’ and ‘Kiwi’ Dollars have been unsettled by the Ukrainian conflict because it poses a threat to the global economic climate. This uncertainty has fueled risk aversion, which in turn has softened demand for the Australian Dollar and the New Zealand Dollar.

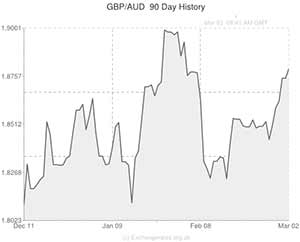

The Pound to Australian Dollar exchange rate (GBP/AUD) surged to a monthly high of 1.8825.

And the Sterling to New Zealand Dollar exchange rate (GBP/NZD) rose by around a cent to 2.0060.

The high-risk Antipodean currencies were also hurt by a report from China indicating that Manufacturing output in the world’s second-largest economy sunk to its lowest level for eight months in February. The Chinese Manufacturing PMI softened from 50.5 to 50.2 last month as demand weakened slightly.

The report bodes badly for AUD and NZD because China buys more of Australia and New Zealand’s goods than any other country, meaning that if Chinese output slows so too could export volumes from Australia and New Zealand to China.

GBP/AUD and GBP/NZD strength persisted through the night as weak risk sentiment was exacerbated by an even more worrying Chinese Manufacturing report from HSBC. The HSBC/Markit factory output PMI came in at 48.5, down from 49.5 in January. Hongbin Qu of HSBC China said that the result was ominously weak:

“Signs have become clear that the risks to GDP growth are tilting to the downside”.

It is unlikely that either the Australian Dollar or the New Zealand Dollar will gain much ground against the Pound today unless this morning’s UK Manufacturing PMI result disappoints. Analysts are expecting a score of around 56.5, but it will probably take a reading below 56.0 to negatively impact GBP/AUD or GBP/NZD.

Early tomorrow morning the Reserve Bank of Australia will announce its benchmark interest rate for March. It is widely expected that the RBA will hold rates at 2.50%, but any surprises could have a significant influence on the ‘Aussie’ Dollar.

Comments are closed.