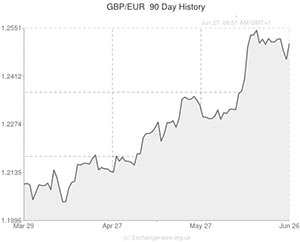

The Pound to Euro exchange rate (GBP/EUR) breached psychological resistance at 1.25 and the Sterling to US Dollar exchange rate (GBP/USD) overcame significant resistance at 1.70 yesterday as markets reacted to the latest policy statement from the Bank of England.

BoE Governor Mark Carney announced a new set of rules for mortgage lenders, aimed at cooling down the rapidly overheating housing market and preventing a bubble forming.

These measures included an ‘Affordability Test’ to make sure that borrowers can afford to repay their mortgages if interest rates were to rise by 3.00% and a ‘Lending Cap’ to prevent banks handing out more than 15% of their mortgages to people with salaries less than 4.5 times as large as the total loan.

Carney claimed that the measures were more effective than ‘bluntly’ raising interest rates, however, the Governor also mentioned that the precipitous acceleration of house prices is currently the biggest threat to financial stability in the United Kingdom.

Investors were not impressed with the housing measures and it is widely believed that, despite the Governor’s protestations, the announcement was merely a precursor to a rise in interest rates, which is likely to prove more impactful. Subsequently, demand for the Pound increased and Sterling was able to breach key resistance measures against its two most-traded currency peers: the Euro and the US Dollar.

Later on this morning the Office for National Statistics (ONS) is scheduled to announce its final revision of first quarter British Gross Domestic Product. The majority of economic forecasters expect the ONS to maintain its initial assessment of an expansion of 0.8%. If these forecasts prove accurate then it is likely that GBP/EUR will trade above 1.25 and GBP/USD will remain above 1.70 in the aftermath of the report.

However, there have been considerable upgrades to first quarter construction data, which raises the prospect that GDP could actually have accelerated at a faster pace during the first three months of the year. If I were to hazard a guess, I’d have to predict that the report will feature an upgrade to 0.9% growth. If this forecast proves accurate then there is scope for Sterling to push ahead against the Euro and the US Dollar.

It is unlikely that a 0.1% GDP upgrade will push GBP/EUR or GBP/USD materially higher, however gains of 0.3 to 0.5 cents are entirely possible.

UPDATED: 17:25 GMT 27 June, 2014

Pound (GBP) Softer as Euro (EUR) and US Dollar (USD) Supported by Domestic News

While the Pound (GBP) exchange rate spent much of Friday in a stronger position against the US Dollar (USD) and Euro (EUR), it went on to pare gains and fall below technical resistance levels after economic reports from the Eurozone and US impressed.

As Friday progressed the German inflation report showed a more rapid acceleration in prices than expected, reducing the odds of deflation darkening the Eurozone’s horizons, and the US University of Michigan Confidence report showed a jump in sentiment which economists hadn’t expected.

Next week is particularly data heavy and Pound (GBP) volatility can be expected.

Comments are closed.