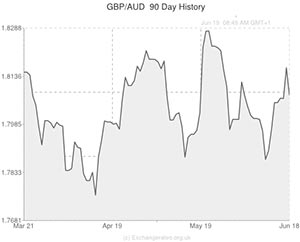

The Pound made strong gains against the majority of its most traded peers on Monday including the Australian Dollar as market sentiment was battered by mounting concerns over fears of a new Gulf War and on comments made by Bank of England’s deputy governor.

The UK currency managed to breach the $1.70 level against the US Dollar for the first time since 2009 after and advanced against the Australian Dollar after Bank of England Deputy Governor Charlie Bean said that he would welcome an interest rate rise as it would be a further signs that the UK economy is returning to normal.

The ‘Aussie’ meanwhile softened following the comments and was under pressure against other peers as concerns over the Sunni insurgency in Iraq weighed upon demand for commodity and riskier assets.

Strangely the ‘Aussie’ did not decline as much as most economists would have expected against its major peers with some suggesting that the currency is emerging as a ‘safe haven asset’.

“There’s certainly something going on. There’s a different kind of behaviour around the Australian Dollar than there has been in the past. It is being treated more like a safe haven asset,” said HSBC’s chief economist Paul Bloxham.

Further declines for the ‘Aussie’ are unlikely as the currency continues to benefit from demand from foreign investors following the European Central Bank’s decision to cut interest rates and introduce a negative deposit rate.

Investor attention will now be focused on tomorrow’s Reserve Bank of Australia policy meeting minutes. Economists will be looking for signs that the economy is strengthening and will try and gauge what direction policy makers see the ‘Aussie’ heading.

It is likely that the minutes will try and talk down the value of the currency in order to aid the nation’s exporters.

Pound to Australian Dollar Update – 19/06/14

The Australian Dollar rallied strongly against the Pound, US Dollar and other major peers on Thursday after the US Central Bank said that it saw no need to raise interest rates anytime soon.

The US Central Bank also lowered its growth forecasts for the world’s largest economy. It now expects the US economy to expand by 2.2% this year, far lower than its previous forecast for growth of 3%.

With no interest rate rise likely this year in the US the Australian Dollar once again appealed to investors looking for higher yielding assets. Australia’s record low 2.5% interest rate is far higher than the near zero rates being seen in the US, UK and Eurozone.

“The prospect of US interest rates remaining low over the near-term is a positive for the ‘Aussie’ and New Zealand Dollar as traders are attracted to their relative yield advantage,” said a market analyst from FXCM.

The Pound was also weakened after yesterdays Bank of England policy meeting minutes disappointed investors and as today’s retail sales data came in well below forecasts.

Comments are closed.