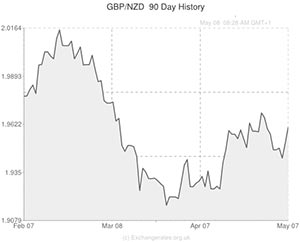

Yesterday the GBP to NZD pairing rallied as Tuesday’s impressive UK services report kept the Pound supported and the Reserve Bank of New Zealand talked down the ‘Kiwi’.

The central bank hinted that it may have to intervene in the currency market if the domestic currency’s strength continues to have an adverse impact on New Zealand’s trade prospects.

Accordingly, the New Zealand Dollar posted widespread declines against its peers (dropping by 0.9 per cent against the US Dollar) and the currency failed to recover losses overnight.

While the Australian Dollar was bolstered by surprisingly upbeat domestic employment and Chinese trade figures, its New Zealand counterpart was left struggling.

Since the Reserve Bank of New Zealand became the first developed-nation central bank to increase interest rates the ‘Kiwi’ has been trending higher, a circumstance the RBNZ was hoping to avoid.

Positive domestic reports have also ensured that the New Zealand Dollar maintains a largely bullish relationship with rivals like the ‘Greenback’ and Pound.

As a result, RBNZ Governor Graeme Wheeler asserted; ‘The Reserve Bank considers that the exchange rate is overvalued and does not believe its current level is sustainable […] if the currency remains high in the face of worsening fundamentals, such as a continued weakening in export prices, it would become more opportune for the Reserve Bank to intervene in the currency market to sell New Zealand Dollars’.

During Australasian trading New Zealand’s QV house price report had little impact on the ‘Kiwi’.

The data showed an 8.4 per cent increase in house prices in April, year-on-year – down from an annual increase of 8.8 per cent in March.

As China is one of New Zealand’s main trading partners, the news that the Asian nation’s imports and exports climbed in April (rather than falling as forecast) did offer the ‘Kiwi’ some modest support.

Imports advanced by 0.9 per cent on the year following the 6.6 per cent decline recorded in March while exports were up 0.8 per cent versus expectations for a 2.1 per cent decline.

As European trading got underway the Pound was brushing multi-month and multi-year highs against currencies like the Euro and US Dollar.

With investors focusing on the upcoming Bank of England rate decision Sterling was unmoved after the UK’s Halifax house price report was published.

House prices dipped by 0.2 per cent on the month. An increase of 0.9 per cent had been projected.

The BoE is expected to leave interest rates unaltered and the level of asset purchases unchanged.

If the central bank acts in accordance with predictions the Pound is unlikely to experience much movement.

However, if the BoE uses this opportunity to release a policy statement (perhaps hinting at the prospect of future rate hikes) broad-based Sterling gains could occur.

New Zealand’s card spending figures for March are due out at 23:45 GMT.

New Zealand Dollar (NZD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

New Zealand Dollar, ,US Dollar,0.8653,

,US Dollar,0.8653,

New Zealand Dollar, ,Euro,0.6222,

,Euro,0.6222,

New Zealand Dollar, ,Australian Dollar,0.9236,

,Australian Dollar,0.9236,

New Zealand Dollar, ,Pound Sterling,0.5108,

,Pound Sterling,0.5108,

US Dollar, ,New Zealand Dollar,1.1559,

,New Zealand Dollar,1.1559,

Euro, ,New Zealand Dollar,1.6094,

,New Zealand Dollar,1.6094,

Australian Dollar, ,New Zealand Dollar,1.0846,

,New Zealand Dollar,1.0846,

Pound Sterling, ,New Zealand Dollar, 1.9579,

,New Zealand Dollar, 1.9579,

[/table]

Comments are closed.