Yesterday’s slightly disappointing UK manufacturing report saw the Pound drift lower against the majority of its most traded currency rivals.

As European trading opened the British asset was heading for a sixth day of declines against its US rival and was softer against the Euro.

However, Sterling was able to claw back losses on Tuesday as the UK’s construction sector was shown to have put in a valiant performance in January.

The Markit construction PMI rose from 62.1 in December to 64.6 in January rather than sliding to 61.5 as forecast.

The jump in output was the most impressive since before the onset of the global economic crisis and indicates that the UK is finally beginning to tackle its housing shortage.

According to the report, all three of the subcategories which make up construction recorded impressive expansion, with housing activity increasing at the most rapid rate for a decade.

Job creation also increased.

Markit economist Tim Moore said this of the construction figures; ‘The latest data show positive developments on a number of fronts, with job creation rebounding at the start of the year while output and new business growth was the fastest since the summer of 2007 […] strengthening domestic economic conditions spurred greater spending on commercial projects in January. A sharp rise in civil engineering activity completed an impressive showing from all three sub-categories of construction’.

Sterling recovered some of its recent losses after the report was published, although it continued to trade lower against a boosted Australian Dollar.

The Pound’s gains on the Euro were aided by concerns surrounding Thursday’s European Central Bank rate decision.

Last week’s disappointing inflation data increased the odds of the ECB intervening to shore up the Eurozone’s economic recovery and lessened the appeal of the Euro. Although the common currency was buoyed yesterday by impressive domestic manufacturing data, gains proved short lived.

As the UK’s services industry contributes the most to national growth, investors will be taking a keen interest in tomorrow’s UK services PMI.

The index came in at 58.8 in December and another month of impressive expansion could lend the Pound support ahead of the Bank of England’s policy announcement.

As the day progresses the GBP/USD pairing could fluctuate further as a result of UK factory orders figures. If orders drop by 1.8 per cent, as forecast by economists, the Pound could advance.

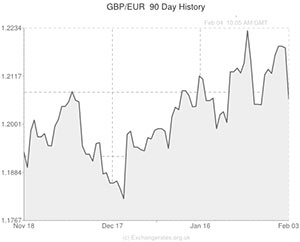

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.6293 ,

,US Dollar,1.6293 ,

Pound Sterling, ,Euro,1.2058,

,Euro,1.2058,

Pound Sterling, ,Australian Dollar,1.8324,

,Australian Dollar,1.8324,

Pound Sterling, ,New Zealand Dollar,2.0021 ,

,New Zealand Dollar,2.0021 ,

US Dollar, ,Pound Sterling,0.6135,

,Pound Sterling,0.6135,

Euro, ,Pound Sterling,0.8293,

,Pound Sterling,0.8293,

Australian Dollar, ,Pound Sterling,0.5454,

,Pound Sterling,0.5454,

New Zealand Dollar, ,Pound Sterling,0.4998,

,Pound Sterling,0.4998,

[/table]

Comments are closed.