Although yesterday’s below-target services PMI report for the UK left the Pound a little weaker against its major rivals, the British currency was holding fairly steady as trading got underway on Tuesday and investors looked ahead to the UK’s major data releases at the tail end of the week.

The measure of the UK services sector may have showed a slower pace of growth than expected, but comments issued with the figures were still upbeat and limited Sterling losses.

For example, David Noble of the Chartered Institute of Purchasing and Supply stated; ‘The UK services sector continues to hit the high notes as business confidence surged to its highest level in nearly four years. The average new business growth rate in the final quarter of 2013 was the best in the survey’s history, suggesting a very bright outlook for 2014. The stronger positive outlook also offers a platform for investment and expansion in new products and marketing, sustaining a broad-based recovery in the New Year.’

However, Chancellor of the Exchequer George Osborne’s comments regarding the importance of introducing additional spending cuts to help the UK’s economic recovery progress kept Sterling trading lower against peers like the Euro and US Dollar.

On Tuesday the British asset was little changed in spite of a comparatively upbeat report from the British Chambers of Commerce.

The BCC document indicated that local businesses enjoyed strong growth and rising confidence in the final quarter of 2013, a sign that the UK’s economic recovery will continue to gather momentum.

The BCC envisions growth of 0.9 per cent in the fourth quarter following expansion of 0.8 per cent in the third.

It was stated that ‘it is clear that the UK recovery is likely to continue to strengthen in the short term.’

Today the modest fluctuations in the EUR/GBP pairing were largely driven by Eurozone data releases, including reports showing improvement in Germany’s retail sales growth and unemployment.

While the Euro was supported by these developments, a less than inspiring inflation report for the Eurozone prevented the common currency from adopting an entirely bullish relationship against the Pound.

Given that this week’s major UK news is due for release towards the close of this week it seems likely that Pound movement will be a little restrained until then.

But Sterling volatility will almost certainly occur on Thursday following the release of UK trade balance data and the Bank of England rate decision.

During North American trading US trade balance figures will impact the GBP/USD pairing.

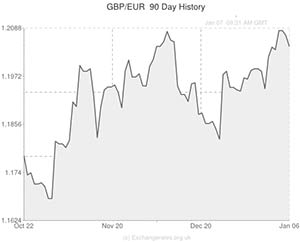

Current Pound Sterling (GBP) Exchange Rates:

< Down > Up

The Pound Sterling/US Dollar Exchange Rate is currently in the region of: 1.6413 >

The Pound Sterling/Euro Exchange Rate is currently in the region of: 1.2031 <

The Pound Sterling/Australian Dollar Exchange Rate is currently in the region of: 1.8394 >

The Pound Sterling/New Zealand Dollar Exchange Rate is currently in the region of: 1.9812 >

The US Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.6097 >

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8316 >

The Australian Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5434 <

The New Zealand Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5045 <

(As of 11:30 GMT)

Comments are closed.