On Friday the Pound posted gains against the US Dollar as the North American asset floundered following a second disappointing US non-farm payrolls report.

Sterling also managed to recover ground against the Euro as German industrial production declined unexpectedly, the UK’s trade deficit narrowed and growth data showed that the UK economy expanded by 0.8 per cent in January.

However, the British currency trimmed gains against its major rivals this morning as investors focused on the Bank of England’s inflation report – due out on Wednesday.

Although the BoE recently stressed that it sees no immediate need for borrowing costs to increase, it is believed that the central bank will offer new guidance regarding a potential time frame for the raising of interest rates.

In spite of economists forecasting that the British Retail Consortium will reveal a 0.8 per cent monthly increase in like-for-like sales in January when the report is published tomorrow, the Pound edged slightly lower against the US Dollar and Euro.

However, Sterling losses were a little limited by the news that the Lloyds employment confidence measure jumped from -12 in December to -2 last month, a significant improvement.

Meanwhile, a separate measure of business optimism hit a 22-year high in January, advancing from 103.4 in December to 103.8 last month.

The BDO employment index achieved 101.3 and its highest level since mid-2008 in January.

One BDO official issued the following statement with the figures; ‘UK business confidence has hit record highs as we enter 2014 and we expect the economy to grow rapidly in the first half of the year. Companies are raising headcounts in response to rising client demand and the data suggests that the unemployment rate is likely to fall below the Bank of England’s 7.0 per cent threshold for considering raising interest rates in the very near future.’

With global economic news thin on the ground in the hours ahead, Sterling may continue trading in a narrow range throughout the European session.

Influential British data is a little limited over the next few days, although economists will be looking out for tomorrow’s BRC like-for-like sales numbers, the publication of the Bank of England’s inflation report on Wednesday and UK construction output figures on Friday.

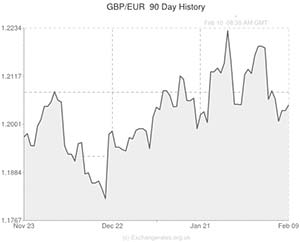

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.6392 ,

,US Dollar,1.6392 ,

Pound Sterling, ,Euro,1.2026,

,Euro,1.2026,

Pound Sterling, ,Australian Dollar,1.8360,

,Australian Dollar,1.8360,

Pound Sterling, ,New Zealand Dollar,1.9836 ,

,New Zealand Dollar,1.9836 ,

US Dollar, ,Pound Sterling,0.6100,

,Pound Sterling,0.6100,

Euro, ,Pound Sterling,0.8316,

,Pound Sterling,0.8316,

Australian Dollar, ,Pound Sterling,0.5442,

,Pound Sterling,0.5442,

New Zealand Dollar, ,Pound Sterling,0.5047,

,Pound Sterling,0.5047,

[/table]

Comments are closed.